Columnists

Why Ugandans get loans to go betting?

If we are to become a middle-income country, we must drop the numerous growth-retarding habits that we picked from our ancestors!

Sometime ago, I attempted to define the various micro-economic characteristics and behavioral weaknesses of a typical Ugandan that tend to perpetually keep us in a pseudo poverty trap – debt, money worries and financial frustration. By extension, these determine the health of our economy.

I promised, this week, to try and explain the genesis of this problem and propose a few measures that may help us to rebuild our lives towards personal prosperity and national economic transformation.

I promised to answer, first, the question: why and when did Ugandans choose to live thriftlessly? Is it a cultural issue? Is it in our DNA? The quick answer to all these (related) questions is of course, NO! We were neither nurtured to live profligate lives, nor is it in our blood. A number of things have led us here.

The number one reason people in Uganda live outside their means, is because society has made it so easy to do so. We live in a country where Government, school and family let us do whatever we want to do. We call it freedom; but when unregulated, excessive freedom, may lead people to destroy their lives; and by extension, impede the country from progressing.

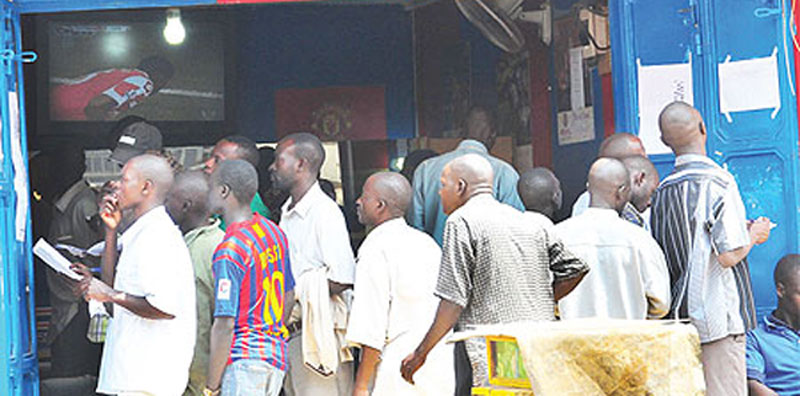

Today, you can sell family land – under Police protection – to go betting. Banks are baiting young couples to go for wedding loans. You can open up a church and seat people in classes defined by the weight of the envelope they give as tithe, under the influence of well-structured celestial ‘terrorism’ from the clergy. It is up to someone to decide whether to save for old age, or their children or not.

Kampala Tycoon S.K Mbuga’s recent lavish wedding with wife Jalia Birungi is considered by many as the wedding of the year. Many a Ugandan would not hesitate to go to the bank to borrow to finance such a wedding

What’s Mañana culture?

In Spain, there is an old saying; “Why do today, what can be done tomorrow.” They call this: “Mañana culture”. It is this culture that stops us from saving or acting on the simple things we can do today to make a big difference for the future.

We need to change this. Government must come up with policies and institutions that encourage saving. Development economics teaches us that a country would find it exceedingly difficult to develop if its citizens are not coerced to defer gratification, that is; create the willingness in people to sacrifice current satisfaction for future gain.

East Asian countries disproved economists who for long had bemoaned the low levels of savings in developing countries, but thought there was little that Government could do. Research has found that East Asia’s high savings rates have everything to do with policy and institutions, and not with culture as earlier thought.

The governments in East Asia, beginning with Japan after 1945, established mechanisms of inculcating the “idea of saving in the minds of the people.” The money to make their investments came from their own people as governments encouraged saving and discouraged the volatile capital flows from abroad.

Credible estimates indicate that, between 1980s and 2000s, the average household saving rate in East Asian countries – Japan, South Korea, Singapore, China, Taiwan and Hong Kong – was 29%. In Singapore, 42% of GDP was saved in the period under review! Governments set up banks in rural areas to garner savings.

We Don’t Save Enough

In Singapore, the Government set up a Central Provident Fund (CPF), starting in July 1955, as a compulsory comprehensive savings plan for all Singaporeans and permanent residents, primarily to fund their retirement, healthcare and housing needs.

Someone may ask; what is new in the CPF that is not in Uganda’s National Social Security Fund (NSSF)? First, under the CPF, every Singaporean must save. Second, the savings are substantial enough. For example, in the days of Lee Kuan Yew, every Singaporean contributed a total of 50% of his income (30% by the employee and 20% by the employer).

At NSSF, the few Ugandans that are saving contribute a paltry 15% of their monthly wages (5% by the employee and 10% by the employer). This is too small to make a difference in total national savings and long- term credit needed for development.

In Singapore, everybody who turned 55 last year received a basic retirement sum of $80,500 ?(or UGX 280 million). With this disposable income, imagine the aggregate demand created in the economy every year, and by extension, the investment expenditure. No wonder, Singapore, just like other East Asian countries, is providing too much demand to its own economy.

Why ‘Dry January’?

In China, under Mao Zedong (from 1952 to 1978), household saving rates did not exceed 2 or 3%; and often sunk to less than 1%. Today, national savings in China has been close to 50% of GDP for the last ten years, and was 48% of GDP in 2015, according to the IMF.

Why? Government policy was used to mobilize the Chinese to save. Following Mao’s death and the advent of Deng Xiaoping in 1978, the state used policy and institutions to encourage households to save. They used policies such as “social pooling”, where enterprises contribute a tax-deductible 20% of their total wage bill to the pension fund; and “individual account”, where workers contribute 8% of their wages, thereby contributing a total of 28%.

In short, the people of East Asia relied on Will Rogers’ wisdom; “The quickest way to double your money is to fold it over and put it back in your pocket.” Children are taught how to save money at an early age. In East Asia, financial literacy is taught in all schools. I strongly feel that governments in Africa have not done enough to prepare their citizens for economic transformation.

But it is not Government alone that needs to do something. Employers, too, should help their workers to save. A friend, running one of the most professional and fastest growing law firms in the country, pro-actively devised a mechanism of helping employees to safely sail through the ‘Dry January’. At this law firm, they pay bonuses in mid-January – not before the festive season, as many companies do. This helps the employees to learn to spend wisely and also to create a fall-back position for the prodigals.

Parkinson’s Law

The ultimate person, however, that must do something to change their own financial and economic fortunes – is the individual. Many Ugandans who earn enough during their working time retire on nearly nothing, since they did not save enough, or sometimes, nothing at all. I have heard so many people claiming that the reason they cannot save is because they earn very little income. Well, if you have not been saving, no amount income will enable you save and invest.

I hope we’ve heard of the Parkinson Law. It state thus; “Expenditure grows to meet income” – our expenses tend to rise in lockstep with our incomes. When our incomes increase, we get bigger homes, bigger cars or possibly consider having more children. Saving is discipline.

Individuals, therefore, must learn to violate the Parkinson’s Law. As Ugandans, we must gradually develop sufficient will power to resist the powerful urge to spend everything we make. We must save and invest to become financially independent in our working lifetime.

Many of us today are earning several times what we were earning at our first jobs. But somehow, we seem to need every single penny to maintain our current lifestyles. This is the reason for debt, money worries and financial frustration.

The reason we are uncomfortable with high interest rates, is because we are net consumers. High interest rates are a reward for saving and penalty for consumption. Here are two things we can do to violate Parkinson’s Law immediately:

First, as Ugandans, we need to acknowledge that, currently our financial lives are like a failing company. Individually, or family by family, we need to institute an immediate financial freeze, halt all non-essential expenses, draw up a budget of our fixed, unavoidable costs per month and resolve to limit our expenditures temporarily to these required amounts.

Growth-retarding habits

Secondly, we need to resolve to save and invest 50% of any increase we receive in our income from any source, starting this year. We must learn to live on the rest of our additional income (the remaining 50%) – and do this for the rest of our careers.

The reason most people retire poor, is that no matter how much money they earn, they tend to spend the entire amount, and a little bit more, besides. This is a bad culture we learn right from our homes. In Africa, we do not budget. Not doing our monthly budget is one culprit of overspending which leads us to not saving.

I often use simple analogues to paint clear pictures for my students. We grew up in homes where mothers cooked for 20 years without knowing the amount of salt required to prepare a kilo of beef. I often saw my mother pour salt in her palm before tossing it into the boiling saucepan. Then, she would draw a few drops of the sauce on to her palm to taste the salt. Sometimes, the salt could be less; sometimes it would be more than the optimal quantity. I would silently wonder; for the entire years mum has cooked, “Why hasn’t she gotten a scale (perhaps a small container) to determine the exact quantity of salt to put in a kilo of beef”?

The current and future generations must carry out what Joseph Schumpeter calls, “Creative Destruction” – adopting new and better ways of doing things to replace the out-dated ones, which often we are more comfortable with and used to.

In 2017, we must drop the numerous growth-retarding habits that we picked from our parents and grandparents: polygamy and its results (many children and family upheavals), early marriages and the Civil Service working mentality; going to work at 8am and leaving at 5pm.

Others include: the collectivist culture (which has perpetuated group spending), believing in witchcraft and magic, too much belief in ‘Manana’ culture, which breeds profligate and impecunious lifestyles; and the dependency syndrome which tends to create a psyche among many Ugandans of inability to improve their own life without ‘foreign’ guidance and help – the “Tusaba Government etuyambe’ mindset.

Comments