Business

Govt assures Ugandans on worrying national debt, but skepticism persists

PSST Mr. Ramathan Ggoobi

The Permanent Secretary in the Ministry of Finance, who doubles as the Secretary to Treasury Ramathan Ggoobi has reassured the country that his Ministry has embarked on measures to reduce the country’s worrying debt situation.

Speaking at the Inaugural Debt and Development Dialogue, held at Kampala Serena Hotel this week, Ggoobi highlighted measures his ministry is implementing to restore the country back onto the path of debt sustainability.

PSST Ggoobi said: “We expect public debt as a share of GDP to be on a declining trend, on the back of robust economic growth, enhanced tax revenue mobilization and increased caution on the expenditure side.”

Ggoobi pointed out measures such as raising tax revenue as well as reducing government expenditure on non-essential items.

On tax revenue, Ggoobi pointed to measures to boost economic growth through the effective implementation of the Parish Development Model, oil & gas investments, growth in services & industry.

On revenue mobilization, Mr. Ggoobi noted that the government will starting next financial year introduce a criteria for accessing tax exemptions by investors and tracking mechanism to ensure that all investors fulfill their promises.

The move is seen by observers as a measure that will help reign in cowboy foreign investors who benefit from generous tax and other government incentives such as free land, but fail to fulfill their commitments such as jobs creation and exports growth.

In the past, craft foreign investors have been cheating Ugandans by registering as new businesses and getting tax exemptions yet in actual sense they are old companies that have been operating in the country and getting freebies. The case for boosting economic growth as a strategy to improve debt sustainability received supporters.

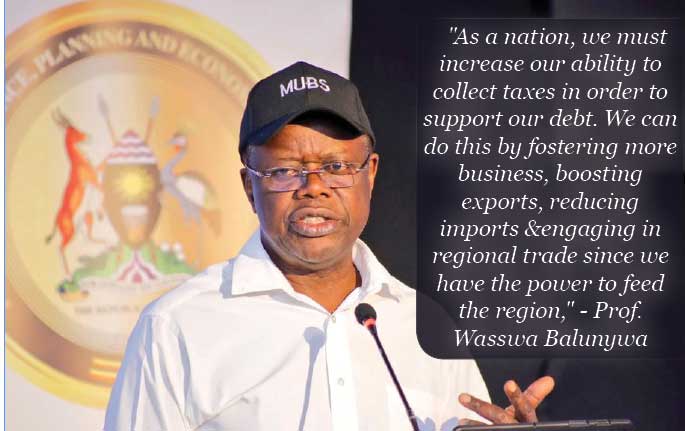

Prof. Wasswa Balunywa, the Principal of MUBS emphasized the need for regional integration as an engine for growth.”As a nation, we must increase our ability to collect taxes in order to support our debt. We can do this by fostering more business, boosting exports, reducing imports &engaging in regional trade since we have the power to feed the region,” said Balunywa.

Prof. Wasswa Balunywa

The debt sustainability dialogue was organised by the Civil Society Budget Advocacy Group (CSBAG), Makerere University Business School to evaluate the impact of Uganda’s debt on budget implemented and overall impact on development.

Ggoobi expressed hope that Uganda’s debt, which rose to highs of UGX 78.8 Trillion (48.4% of GDP in 2022), close to the threshold of 50% of Gross Domestic Product (GDP), is reducing.Ggoobi attributed this reduction to the implementation of a debt sustainability strategy that emphasizes borrowing abroad and on concessional terms.

According to Ministry of Finance, the nominal public debt to GDP is projected to decrease to 47.6 percent by end of the current financial year in June 2023 and will continue on a downward trend over the medium term.

Ggoobi attributed the slowdown in the rate of debt accumulation to a combination of factors including recovery in GDP growth from the lows of 3% to now about 4.7% & Government’s deliberate efforts towards fiscal consolidation as the effects of the COVID Pandemic continue to subside.

Uganda’s runaway debt was partly attributed to the panic that came with the COVID-19 Pandemic and the government’s efforts to control the outbreak.

A 2022 report by the Parliamentary Committee on National Economy revealed that Uganda’s public debt stock had increased by 22 percent from UGX56.938 trillion in the Financial Year 2019/20 to UGX69.513 trillion by end of the Financial Year 2020/21.

Despite the sense of optimism that was projected by the government’s top accounting officer, many participants expressed worry about cracks through which the borrowed money is getting lost.

Dr. Fred Muhumuza the Director of Makerere University Economic Forum, a MUBS Economic think-tank pointed at the profligate expenditure on government cars.

“Can we reduce the motor vehicle fleet? Who is entitled to a government vehicle? Could we consider leasing vehicles as a means to alleviate the pressure of acquisition and shift it to the private sector, thereby promoting its growth?” Muhumuza asked.

The noted economist said that shifting the burden of maintaining cars for civil servants would help to reduce the cost of maintaining the vehicles to the individuals away from government.He also pointed at the fact that the increase in government borrowing especially from the domestic market has negatively impacted the private sector by reducing investments.

“As government debt rises, we noticed that investment in the private sector is declining. That informed us to ask the question, “Is debt hurting the private sector? What is the link between debt payment and sustainability” asked Muhumuza.Other participants were more blunt about the fact that Ugandans have been saddled with debts that have ended up being abused by public servants and failed to deliver the much-needed growth.

Dr. Sarah Bireete, the Executive Director of the Center for Constitutional Governance (CCG) pointed to the fact that whereas Uganda wishes to compare herself with her neighbours about the level of debt to GDP, there is little to show for it.

“Our neighbours have legacy projects to show for the money they have borrowed. Kenya and Tanzania have a Standard gauge railway. When you go there you can observe these changes that have happened in the recent years. And the citizens appreciate it. But in Uganda, there is nothing to show for it,” said Bireete.

Julius Mukunda, the Executive Director of CSBAG, also urged the government to cut its expenditure by dealing with non-performing government project in order to attain debt sustainability. He called for timely debt planning which will enable the country to why and how much to borrow and how to finance as a critical element to debt sustainability “We should cut our costs as a country to ensure debt sustainability.

CSBAG’ Julius Mukunda

Debt planning through a borrowing plan is key for effective budgeting and planning,” said Mukunda.Geofrey Onegi-Obel, a seasoned investment banker and one of the founders of the Uganda Securities Exchange said the problem is not the level of debt, but rather with how the borrowed money is being used.“If you do not contract debt, then you do not have a strategy for growth.

We are not uncomfortable with our level of debt right now, we are uncomfortable with what it is doing,” Onegi-Obel said. Other skeptical voices on Uganda’s debt situation arose from the way Uganda is handling her foreign policy.

Richard Ssewakiryanga, a researcher pointed to the recent passing of the Anti-Homosexuality Act, as a populist and reckless move by Ugandan politicians and one that is likely to endanger Uganda’s debt sustainability plan.

Following the passing of the Anti-Homosexuality Bill 2023 by Parliament of Uganda this week, the international community responded with furry and threats, including the threat by the US to take away funding. The US is Uganda’s biggest funder to its HIV/AIDS programme.

Comments