Analysis

Economic Crisis: How Gov’t can ease the pain

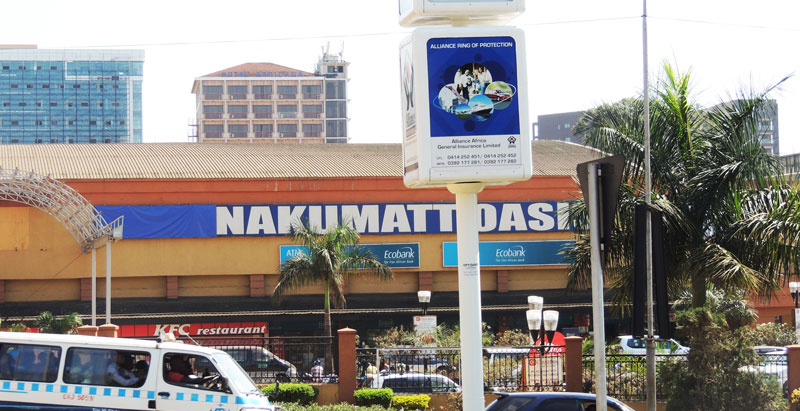

Businesses across Kampala are closing at an unprecedented rate. Some of the biggest shopping malls such as Oasis Mall and Garden City have lost nearly half of their tenants over the past two years because business owners could no longer afford rent.

Many living apartments or mansions in upscale areas such as Kololo, Nagguru are also empty. The situation is made worse by the fact that many of these properties were staked as collateral in banks and owners are

In down town Kampala, there is palpable sense of economic hardship. Shop attendants who have spoken to The Sunrise say they have stayed with imported stock far longer than they used to and yet there is a depreciation of the shilling which means they have to raise prices to maintain some level of profitability. Many cannot take this option though because there are no buyers. Instead, most sellers have either decided to sell low prices to avoid going under.

For sellers of fast moving goods such as clothing, footwear and scholastic materials, shop owners had hired vendors to try to sell some of their stuff on the streets after sensing that customers were evading the shops.

Most people, it’s evident, have seen their incomes diminish over the recent years and as a result they have decided to cut back on their expenses, starting with ‘luxuries’, maintaining cars on the road. Others are finding it tough even to meet the essentials such as school fees and paying utility bills.

Alex, not real name, a former employee of NAADs, who ventured into the private sector running a radio station told The Sunrise that he is struggling to pay workers because advertising has vanished.

He told this writer: “You journalists, tell us what is happening. We are on the edge.”

Busiro south MP Peter Ssematimba’s and manager at Super FM in Kampala also recently had to take some unorthodox steps when he asked workers to take a pay cut or leave the station.

The pessimism held by Alex and several others in the business and academia sharply contradicts the view by government official assurances that the economy is robust and stable.

Diagnosis

Most analysts blame the government for causing the current economic crisis. Many have blamed the government for tolerating high levels of corruption that sucked money meant for investing into productive sectors out of the government treasury.

“Our president has looked on for many years as people stole money that would have gone into supporting local investors,” argued Alex, whose second name he preferred to remain anonymous.

Others blamed the government for handing Uganda’s economy over to foreigners and failing to support local companies to acquire the needed experience, equipment and financial capacity to be able to win lucrative tenders and contracts and hence keep the money into circulation.

Indeed nearly all the big companies in the country are foreign owned. From the telecommunications sector, to construction, beverages, banking,, insurance and pharmaceutical distributors.

The heavy presence of many foreign owned companies in an economy that runs a completely liberal capital account – meaning that investors can bring in and take out money at leisure has exposed the economy to external pressures.

Time for government intervention

Alex argues that it is time for the government to exercise some form of economic control in sectors such as Education, similar to what the Kenyan government did recently by instituting controls on interest rates charged on loans.

Makerere University economics don Dr. Fred Muhumuza in a recent piece argued that whereas Uganda’s economy is ripe for some form of structural reforms, the current political environment cannot allow those reforms to be undertaken because they are painful.

“Can Uganda carry out the necessary reforms on its own? Not with the current state of politics, policies, technical approaches and corruption. Economic reforms involve socio-economic pain that can be politically unacceptable.

“Besides, the country’s current state of the budget deficit and debt is so critical that it needs external support. That is partly the reason there are talks with the World Bank and the IMF for a Policy Support Instrument,” Muhumuza wrote in his regular daily Monitor column. A policy Support instrument, in IMF speak is a loan from the multi-lateral funder. But it usually comes with conditions such as cutting back on cost of public administration.

Invest in people and businesses

Ramathan Ggoobi argues that the time has come for government to intervene into the economy by; investing in people and businesses.

Although the government, has maintained a dogmatic stance of non-intervention into businesses affairs, Ggoobi says the government needs to abandon this standpoint and begin to support businesses.

Support agriculture

Ggoobi says that the government needs to inject money into supporting farmers by providing low cost funds.

“The government also needs to finance off-takers of agricultural produce. There are some people who can buy all cereals produce from Masindi and Kasese only that they do not have the capital.”

Ggoobi argues as well that government needs to build agro-processing centres where they don’t exist. “Government needs to stop funding agriculture through buying inputs to start financing the sector,” argues Ggoobi.

Another way through which government can revive the economy, argues Ggoobi, is by providing loan guarantees to businesses, as well as inject cash into tourism promotion to attract tourists who would bring in quick dollars that can help starve off the worsening current account deficit.

“The government has got to put on hold some long-term investments and direct money towards supporting manufacturers who can ramp up exports,” argued Ggoobi.

Comments