Despite government efforts to encourage business formalisation, many Ugandan entrepreneurs still encounter major obstacles when registering their enterprises or certifying products.

During a policy dialogue hosted by the Economic Policy Research Centre (EPRC), business owners highlighted persistent financial, bureaucratic, and regulatory barriers that discourage formalisation, forcing many to operate informally.

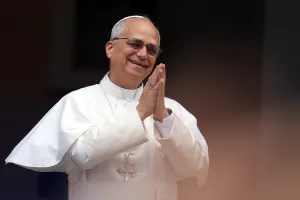

Issa Sekitto, the Acting Chairperson of the Kampala City Traders Association (KACITA-Uganda), explained that while formalisation brings advantages such as the ability to reclaim Value Added Tax, many informal traders see little motivation to register. He noted, for example, that certifying certain products, like electronics, can cost more than 3 million Shillings per item. Sekitto added that any failure in the certification process can incur additional expenses, potentially running into millions, alongside lengthy bureaucratic procedures.

“These challenges lead some traders to bypass formal channels altogether,” Sekitto said, noting that smuggling sometimes becomes an alternative, a problem worsened by the lack of harmonised taxes across the East African region.

Sekitto’s remarks followed a presentation by Emmanuel Erem, a Research Analyst in the Macro Economics Department at EPRC, who shared findings from a study assessing whether Uganda’s regulatory environment supports or hinders formalisation.

Erem acknowledged that while initiatives such as the Tax Payer Register Expansion Programme (TREP), the Fiscal Receipting and Invoicing System (EFRIS), and Kampala’s online trade license registration system exist, “little attention has been given to streamlining the broader regulatory framework to genuinely support business and worker formalisation.”

He recalled that in 2012, the government sought to reform business licenses, fees, and levies after discovering that ministries and local governments were issuing 790 licenses, permits, and user charges nationwide. However, high administrative costs continue to burden sectors such as agriculture, trade, tourism, and transport and logistics. Of the 137 proposed license eliminations or reclassifications, only 59 have been implemented, leaving the reform incomplete.

EPRC data shows that informality is highest in agriculture and mining, while utilities and education report the lowest levels. Joseph Enyimu, Commissioner of Economic Development Policy at the Ministry of Finance, stressed the need for a dedicated agency to register non-individual business entities as a way to boost formalisation.

The study also highlighted the vulnerabilities of informal employment: 92.9 per cent of informal workers lack insurance, 76.6 per cent work without contracts, 72.2 per cent contribute nothing to social security, and 71 per cent have no employment benefits such as annual or maternity leave.

Erem pointed out the stark enforcement gaps, noting that only 21 labour inspectors are tasked with overseeing more than ten million workers, rendering the Ministry of Gender, Labour, and Social Development’s labour inspection office largely ineffective. Enock Mutambi, a labour expert at the Ministry, acknowledged that while the office functions, the number of officials is insufficient to cover the country adequately. Currently, there are 117 labour inspectors at the local government level, essentially one per district.

Sunrise reporter

Leave a Comment

Your email address will not be published.