human traffickingFeatures

Pay MPs well, put them under pressure

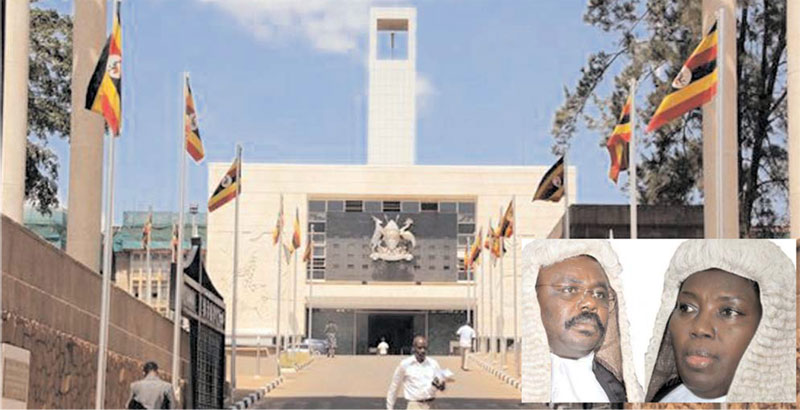

The parliament of Uganda (Inset) is Speaker Rebecca Alitwala Kadaga (R) and her Deputy Jacob Oulanyah

In recent weeks, public space was awash with the debate on whether the mileage allowance for Members of Parliament should be taxed. A number of commentators dismissed MPs of the 9th Parliament as “greedy” for passing a Bill to exempt MPs’ allowances from taxes.

We should remember however, that many of the MPs who passed the said Bill had lost their constituencies in the February elections and were therefore not going to benefit from the proposed tax waivers. It is therefore clear that their decision was not based on what they hoped to benefit as individuals, but having been in Parliament themselves, they were convinced that this was the right thing to do.

It is important to point out this issue from the outset in order to make the point that the proposal is not out of selfishness on the part of MPs as the public has been led to believe.

Background

Those who followed the debate will recall that the MPs’ proposal for their mileage allowances not to be taxed stemmed from a pronouncement that emanated from elsewhere within government circles that the pay for MPs in the 10th Parliament would not be enhanced.

For the record, MPs’ current salary, minus allowances, is Shs 11.18m per month before taxes are deducted. After deducting Pay As You Earn (PAYE) and pension contributions, the MP takes home Shs 6.1m. The point that this figure is much lower than what MPs in neighbouring countries are paid has been made frequently.

As sitting allowance, each MP is paid Shs 50,000 per sitting in a committee and is not paid for plenary sittings. The Ushs 50,000 is subjected to a 40 per cent tax, leaving Shs 30,000 per sitting per MP. The MPs’ annual gratuity is also subjected to a 40 per cent tax, leaving MPs with an annual gratuity of Shs 24m.

A chairperson of a committee is paid an honorarium of Shs 2.5m per month, while a deputy chairperson gets Shs 1.8m. This money too is subjected to PAYE.

Clearly, the foregoing shows that MPs pay taxes. The only argument is on MPs being exempt from paying taxes on mileage allowance, which is considered as facilitation for MPs to do their work.

The mileage allowance is computed depending on the distance from Parliament to the farthest point of the constituency the concerned MP represents. The mileage allowance for the Kampala Central MP, for instance, will be computed based on the distance between Parliament and the farthest point of the constituency, may be Old Kampala or thereabout. The farther away from Parliament one comes from, therefore, the higher the mileage allowance. But this is just to facilitate the MP to come to work.

The argument contained in the proposal for not taxing mileage allowance is that the allowances are calculated based on the actual fuel prices and the distances MPs have to cover. Taxing the mileage allowances would mean MPs would be constrained to travel to and from their constituencies.

For comparison purposes, other public servants from the other two arms of government – ministers (Executive) and judges (Judiciary) – have their official vehicles fueled by the tax payers and have no business worrying about fuel prices or fuel allowances being taxed.

In addition, the other public servants, driving government vehicles, have the vehicles maintained by the government, and they have drivers paid by the government. The MPs, on the other hand, are only given a stipulated amount of money to buy a vehicle once in five years.

They do not have their drivers paid by the government and they maintain their own vehicles. In terms of transport facilitation, therefore, it is clear that MPs impose the least burden on the tax payer, compared to ministers, judges, and even senior civil servants.

Hate campaign?

This clear fact then begs the question: Are some people, by demonising Parliament and making MPs appear excessively paid and greedy, looking to incite the public against their legislators and depict Parliament as a useless entity?

We say this because much of what is said about MPs’ pay, in fact, is misleading. Weeks ago, for instance, one newspaper claimed that every MP would be entitled to Shs 50m as wardrobe allowance. There is no such entitlement to MPs, and this fact was clarified. There are a number of similar untruths that have over time been said about Parliament.

The truth that is hardly told to the public is that Parliament is actually grossly underfunded. For well over a decade, for instance, the institution of Parliament has been getting less than 2 per cent of the national budget. The ideal proportion of the budget that should be going to the Legislature should be much higher, and this point has consistently been made.

If the objective of some people is to depict Parliament as overfunded and MPs as greedy, therefore, it is definitely wrongly premised. The truth is that Parliament needs more, not less, facilitation in order to do its job effectively.

We should recognise that Uganda took a conscious decision to be a democracy and, as we should know, the legislature must play a central role in a democracy. The Executive arm of government will not be effective if there is no powerful and independent Parliament to hold it to account. The Legislature, also, must pass quality laws that the Judiciary will then interpret to foster harmony and prosperity in the country.

These important roles of Parliament imply that MPs have to do quality work by investing time and being dedicated to their functions. Ugandans will reap maximum benefit out of MPs if they pay them well and put them under extreme pressure to deliver on the key functions of Parliament.

Comments