Business

SACCOs: Changing mindsets key to enabling them serve members better

Following our pioneering reports last week on the challenges facing the Microfinance sector in Uganda, including politicization of government contributions, week legal regime and weak supervision, there appears to be a ray of hope that the sector will experience some order in the near future.

In an Interview with The Sunrise’s Henry Lutaaya, Colin Agabalinda, the SACCO Development Manager at the Project for Financial Inclusion in Rural Areas (PROFIRA), a US$30m loan project from the International Fund for Agricultural Development (IFAD), revealed the government’s efforts to restore some order in the foundations of the microfinance industry. Below are excerpts.

Qn. Why was PROFIRA established and how different is it from previous government programmes targeting SACCOs?

Ans: The government has had a long history supporting financial inclusion in areas where commercial banks do not reach because they are mostly located in urban areas. If you may remember, we had the Poverty Alleviation Programme (PAP), then came the Micro-finance Outreach Programme, the Rural Financial Services Programme (RFSP), an IFAD US$29m loan programme, that was partly developed to support the rural finance support strategy, and now PROFIRA.

The only thing that has changed is the method. Initially, government had what you would call direct intervention. You remember the Entandikwa scheme where the government was the direct lender through the LC system. After realizing it wasn’t working, the government shifted to a strictly private sector-led intervention when it put money in micro-finance institutions like FINCA, Pride Micro-finance among others. But there were outcries from people regarding high interest rates and hash methods of recovery etc.

What we’re seeing today is a new strategy of bringing the public and private together. Supporting SACCOS or Community Savings and Credit Institutions to be able to mobilize their own savings so they can access them as loans. You now have a mixture of public and private.

Qn. What are the key lessons to pick from that history?

Ans. One, Government’s direct intervention is not the best. As I told you, during the Entandikwa scheme, so many people accessed credit but the repayment was poor as people claimed the money wasn’t disbursed as it should have been. But the key problem was the way most people perceived it as Kasiimo (token of appreciation). The lesson is that government is not the best lender because the methods of use will be challenged, enforcement of recovery will be a challenge.

Also, when the government announced the micro-finance outreach strategy, it was primarily focused on SACCOs, and after developing the RFSP that was redesigned to support only SACCOs, we learned that while SACCOs did well in the South and the Central regions, in other parts especially in the East and the North, majority of the SACCOs were failing. And yet we saw other financial services such as Village Savings Groups doing well.

The lesson was that you cannot have a one size fits all. If your purpose is financial inclusion, you can use several vehicles. There has to be a multi-pronged approach to financial inclusion which is why PROFIRA does not support SACCOS alone, it supports VSLAs as well.

Qn. How many institutions have you supported and what is your target?

Ans: PROFIRA targets to strengthen 500 SACCOs by 2022, and a minimum of 18,000 Savings and Credit Groups. Since PROFIRA started in 2015, we have identified 453 SACCOs and in our first three years of contracting, we expect that at least 7500 VSLAs will be established.

The project is not establishing new SACCOs but strengthening existing ones. We also aim to establish credit and savings groups where non-existed as well as work with existing groups to strengthen them.

By establishing groups, we don’t go around villages and telling people to form groups.

We know that people already have different groups for diverse purposes. Some of them are burial groups like Munno mu Kabi (self-help group) others are pyramid schemes or circles where people collect money on a regular basis and give it to one person in an unsustainable manner. Many people have baptized these groups as SACCOs, which is not the case.

A SACCO must be registered with the Registrar of Cooperatives and operated along the principles of a Cooperative; being member-owned and governed for the benefit of the members themselves.

Qn. What problems have you identified with SACCOs?

Ans: SACCOs have problems in three main areas. Governance, Management and as well as in the area of membership – members who are financially illiterate.

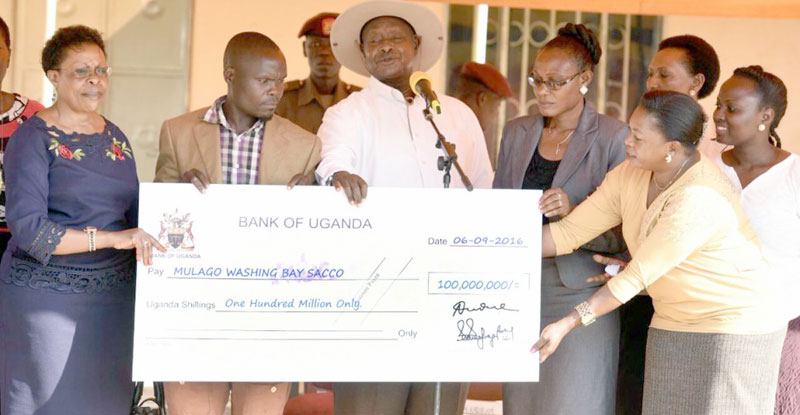

When you enter into a struggling SACCO and ask them what is your problem, they will tell you we do not have money. By that they mean that when members want to take their money, it is not there or it’s all in loans. So if a politician walked into that SACCO, he would think the best thing to do is to make a big cash donation of say Ushs500m. This has not shown to solve the problem of the SACCO. The question is why does the SACCO find itself in a situation with no money yet it is called a Savings and Credit, meaning people are not saving enough or if they are saving enough, the managers are not managing it is a prudent way to be able to recover it.

Qn. How do you help such SACCOs?

So at PROFIRA we have focused our intervention in capacity building. Providing training in the areas of; Governance, Financial literacy, Training in entrepreneurship and business skills development, Financial management, Strategic planning, Savings and other product development as well as train management in Credit and default management. We also provide support through computerization.

Qn? Why do members fail to save? Is it our culture?

Ans. I don’t believe it is our culture not to save. Actually poor people in rural areas save. The difference is that they tend to put their savings in physical assets like animals, land. You can’t blame them entirely because what is the incentive to save in a bank?

Secondly, if they’ve heard stories where a certain manager has run away with people’s money, or if there are members of a SACCO whose board is comprised of people who are not credible. So people do not save because they don’t have the trust in the leadership and management of the institutions.

That is where PROFIRA comes in: To make them attractive, credible and reasonable so that when someone comes, is able to find them more attractive than buying a cow or a goat.

Secondly, if the institutions are not credibly managed, one dissatisfied member can call off so many others, but if we work with SACCOs, we help them with good financial management.

In northern Uganda where Community Savings Groups alternatively called Village Savings and Loan Associations (VSLAs) thrive, people are able to save millions of money because they trust each other and they are seeing the benefits of their money.

Qn. How do you support VSLAs?

In the case of a VSLA, what we do is to introduce to them a tried and tested methodology. This involves a complete course on how to do savings, credit and welfare and not to mix them.

The methodology gives proper directions on how a group should be formed, how meetings should be held, how the executive should relate with management, how a proper business meeting should be conducted from start to finish, how the records should be kept, what is the ratio of savings to loans, how an appraisal should be conducted.

In addition to the course, we provide groups with kits including stamps, cash books, then we say we have established a group.

Qn. How do you distinguish between a SACCO and a VSLA?

A VSLA is an informal group made of about 25 – 30 people. Members select among themselves the chairman, secretary and treasurer. They agree on which day of the week they are supposed to meet and the amount each is supposed to save. The maximum one can save is determined by the minimum they’ve agreed to save because they save in multiples up to an agreed limit.

If everyone has saved, the chairman announces how much they’ve each saved and how much collectively. He then asks who wants to borrow, for how long and for what purpose.

An appraisal is done and a decision is taken there and then. If there is anyone in the group who thinks the applicant has intension of failure to pay, he/she will rise up and say I know so and so has been trying to shift, we shouldn’t give him/her our money. They are free to say so. At the next meeting, they meet and repeat the cycle. The process has no costs and is transparent. At the end of the year, they count the money they’ve saved, including interest and share out everything.

On the contrary, a SACCO is a formal institution. It has a board of directors who earn allowances, its has staff, offices, When someone comes and wants to save with a SACCO, his money may be making profit, but because of the inefficiencies that may exist, the board and management may be eating away the profits through fat salaries and allowances. So at the end of the year they report that we got savings but made a loss.

If the SACCO has not embraced the right principles of growing a cooperative and as a business enterprise, they may find themselves in a situation where they misuse members’ money and at the end of the year, they are reporting nothing in terms of dividends to members.

But for the groups, once someone has defaulted, they will know it the next week and when the meeting ends, they will stop at that person’s doorstep. Community pressure will compel that person to pay.

As PROFIRA, what we do is to help SACCOS have an effective Supervisory Committee (SUPCO) – that helps the AGM to perform regular spot checks throughout the year. It reports to the AGM.

Comments