Analysis

Tragedy as SACCOs succumb to poor governance

SPECIAL REPORT:

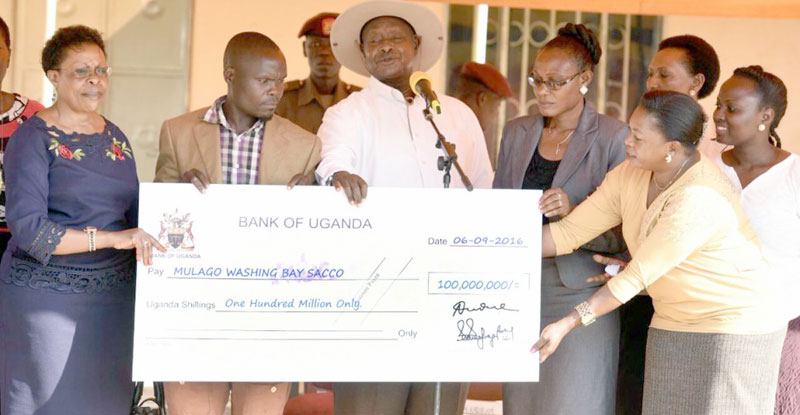

President Museveni handing over a dummy check to members of Mulago washing bay SACCO back in September 2016. The SACCO was not registered by the time they got the money

When President Yoweri Museveni donated one billion shillings as seed capital to the National Leaders Empowerment Cooperative (NALECO), he probably meant well.

With such big guns as Capt. Mike Mukula, Daniel Kidega current speaker of East African Legislative Assembly (EALA), as members, NALECO went into business with high expectations.

Although the organisation had been registered as a SACCO, it soon emerged that the expectations of members were at variance with the norms and objectives of a cooperative. Whereas its primary focus should be to mobilise members’ own resources for on-lending within the group, NALECO’s subscribers considered the SACCO a cash-cow that would solve the myriad financial problems they were facing. The SACCO did not record a single penny in savings nor did it lend to its members.

“I don’t know if we should blame the President’s offer because rather than mobilise savings, it pointed members in the direction of expecting the SACCO to provide financially-distressed loyal supporters, a source of livelihood,” says a source who preferred anonymity.

According to the source, when President Museveni first convened a meeting of NALECO’s leaders led by their chairman and former contestant for the Kyadondo East constituency, Mr. Sitenda Sebalu; he asked them to come up with a viable business plan that would generate revenue that could be accessed easily by financially-troubled members, particularly those that had lost elections. The same business would then support successive generations of NRM Parliamentary losers, and perhaps avoid losing them to the opposition, due to poverty.

“The President advanced the group one billion shillings to buy buses. They bought three Isuzu buses at a total cost of Ushs750m. The members then demanded that the balance of Ushs250m be shared out – and so they did,” the source adds.

But the business began to unravel almost immediately. The managers faced an endless stream of demands for cash from members. At the same time, the buses were plying the difficult Kampala – Moroto route, which led to constant mechanical breakdowns. As time went by, members would even stop the buses along the way asking for money, the source says.

The last blow to what had originally started as a SACCO, came when the leaders allegedly mortgaged the buses to Equity Bank for a Ushs 250m loan but instead of ploughing the money into the business; shared out the proceeds amongst themselves. The buses were sold off to raise money to pay off the loan.

“The President was aware of the sad state of affairs at NALECO, but did not intervene. I doubt he will ever support such an initiative again,” noted the source.

Sitenda Sebalu, the former Kyadondo Constituency Contestant, was also the Chairman of NALECO SACCO

When The Sunrise contacted Sitenda Sebalu for a comment, he referred us to another former NALECO member, Richard Mukula who also referred us back to Sebalu. Mukula insisted that as Chairman, Sebalu was best placed to comment.

But NALECO is not an isolated case and reflects the challenges bedevilling SACCO’s in Uganda. A census that was conducted by the research firm Friends Consult in 2007, found that of the 1,724 SACCOs that were on the Register of Cooperatives at the time, only 628 were traceable and operational.

As of January 2017, the register had grown to 8,285 according to the spokesperson of the Ministry of Trade, Industry and Co-operatives, Khadijah Nakakande.

Nakakande however, admitted that the Ministry lacks the resources to supervise the SACCOs. “The inspections we do are demand-driven,” she told this reporter.

And as The Sunrise has discovered, the lack of an effective regulator has given leeway to so many dubious organisations masquerading as SACCOs to engage in illegal activities such as taking deposits from unsuspecting members of the public, mortgaging and seizing people’s property.

Across the country, employees of different SACCOs have exploited loopholes in the law to mismanage or steal members’ money. They either lend to relatives, or exaggerate the costs of different activities, according to Collin Agabalinda, the SACCO Development Manager in the Project for Financial Inclusion in Rural Areas (PROFIRA). PROFIRA is currently trying to develop the capacity of SACCOs across the country.

Call for Regulation

There is concern in government circles, or at least among technocrats and other non-state stakeholders with an interest in financial inclusion, that SACCOs and generally the micro-finance industry, urgently need a regulator. But the slow pace of reforms, coupled with contradictory moves by politicians appears to be undermining the spirit of reform.

With the bitter lessons from NALECO and other failed interventions in the micro-finance sector, observers argue that the policy of giving cash handouts to groups undermines the objective of promoting viable savings and credit membership organisations.

Experts in this sector believe the best approach would be for the government to invest in institutional development by educating members, SACCO boards and management in the principles of cooperatives, while also supporting the development of an integrated rural economy.

“SACCOs were the people-owned financial service arm of a highly integrated rural economy. The integrated system has since broken down and SACCOs are today inappropriately seen as part of the micro-finance industry [MFI], a stand-alone rural financial infrastructure, or as financial service set-ups, only remotely related to other drivers of the rural economy,” argued Andrew Obara, a Friends Consult expert in Micro-Finance in a report on SACCOs and MFIs.

He added: “With the production and marketing system fragmented and somewhat un-organized, there are no obvious economic flows that at the local level feed into the SACCOs.”

Problems of Failed SACCOs

For Obara and colleagues, there is little to show for the sound policies on financial inclusion, or the billions of shillings that have been sunk into the sector through different government programmes over the past two decades.

“Government’s broad policy for harnessing SACCOs to provide financial services in rural areas has, for instance, not yet produced significant impact,” Obara wrote in the report. He blamed political interference, ambiguous government programmes such as the one SACCO per sub-county programme, inadequate supervision, collapse of the Cooperative Bank and, financial illiteracy among members; as some of the reasons that have caused the chaos in the micro-finance sector and prevented its growth.

The collapse of SACCOs has created deeper ills in Uganda’s economy beyond the obvious ones, such as entrenching cynicism and lack of faith in financial institutions among the poor.

For example, Obara argues, the failure of SACCOs, has denied many poor people the opportunity to access better prices for their commodities if only they could manage to obtain cash to solve urgent problems, and sell their produce at a later date and at higher prices. Also, the failure of SACCOs has left millions of people excluded from the financial or banking system, which undermines the effectiveness of policies by institutions such as the Bank of Uganda.

As a result, many rural dwellers have turned to physical assets such as; land, animals, as saving ventures, which economists believe undermines banks’ capacity to mobilise savings; and, hence denies businesses the much-needed money to invest and expand the economy.

Dr. Ezra Suruma, a former Finance Minister and pioneer of the Rural Development Strategy, expressed dismay during a recent Economic Forum organised by the Makerere University Business School (MUBS), about the slow pace of reforms for a sector, he described as crucial to the emergence of a Ugandan-owned banking sector, as opposed to one that is currently dominated by foreign banks.

Suruma cited the delayed enactment of the Tier 4 Microfinance Institutions and Money Lenders Act 2016, which is supposed to regulate all SACCOs, money lenders and other MFIs, as having come a decade late.

His argument came against the background of the growing dominance of foreign-owned banks in the country, which has not been backed by a deliberate policy of nurturing locally-owned banks to support crucial sectors such as; agriculture, especially following the collapse of the Cooperative Bank in May 1999.

Suruma argued that, had the reforms been timely, the current challenges in the banking industry; such as high interest rates and short-term lending to crucial sectors like agriculture and manufacturing, and the economy’s exposure to global shocks would have been minimised.

Political Interference

Although a number of studies and reports about the challenges facing SACCOs in Uganda blame politicization as a major stumbling block to the growth of the micro-finance sector, President Museveni has refused to accept blame for government’s policy failures in the sector.

As he handed out a Ushs100m cheque to Wekembe Kawempe Market SACCO in Nabweru, Nansana Municipality in Wakiso District last August, Museveni lashed out at the opposition for blaming the government on failed policies.

“The opposition thinks that uttering divisionary political ideas would fail government plans. They think people would hate the government. This is a joke. They [Opposition] lack the vision for the development of the country,” he said.

Museveni reminded his audience that the government introduced the Entandikwa Scheme to address household poverty but the arrangement was politicized by wrong elements leading to the misinterpretation and misuse of the money.

Disregarded Advice?

Amstrong Byakubo Matovu, the Chairman Nsambya Carpenters SACCO, right, with his secretary for publicity Wilson Muhwezi, have high hopes of growing the entity to greater heights despite many odds that have befallen many such organisations.

After Kawempe, the President donated another 100 million shillings to another newly-established carpenters’ outfit called, Nsambya Carpentry and Crafts SACCO.

When The Sunrise visited the SACCO, which is entirely managed by members, there were signs the SACCO was facing serious challenges.

The members are not eager to grow their savings, as most co-operators would do. The existing savings, the leaders informed this writer, come as part of the mandatory requirement of depositing 10% to one’s account, if they want to access a loan.

Members in the five-month old SACCO may seem lucky to have received the millions from the President, only about two months since their founding. But the honeymoon appears to be coming to an end sooner than many expected.

Amstrong Byakubo Matovu, the SACCO’s Chairman, admitted for example that they are facing challenges getting some members to repay their loans. The SACCO’s secretary for publicity, who also doubles as its loans officer, Wilson Muhwezi, adds: “Members are reluctant to save. People only deposit the 10% (of the loan application) when they want to borrow. In fact when we delay to disburse the loan, they come to us and demand to withdraw their deposit.”

The principles of a SACCO as a member-owned and driven organisation were evidently lacking among the members whom The Sunrise spoke to. When asked whether members supported the principle of savings-mobilisation, Grace Ndagire, one of the members said the group is not meant to be a savings group. “This is not a place you come to for saving. We come here only to borrow.”

Not All SACCOs are Struggling

Most SACCOs have not succeeded. But a few exceptions, backed by vibrant business activities especially in Western Uganda and in the Central region, have defied the odds. SACCOs such as MAMIDECOT in Masaka; Kyamuhunga SACCO in Bushenyi and Kajara People’s SACCO, both in Western Uganda, have thousands of members and boast of billions of shillings in savings and loans.

Agabalinda and Obara agree that a more enlightened population and vibrant economic activities in Western and Central regions have contributed to the relative success of SACCOs in there as opposed to the Northern and Eastern regions.

The future

Going forward, there is reason to be optimistic about SACCOs in Uganda. The enactment of the Tier 4 Microfinance Institutions & Money Lenders Act 2016, is expected to fill the existing regulatory gaps in the industry.

Besides the regulatory enhancements, the current campaign by PROFIRA to establish 18,000 Village Savings and Loan Association (VSLAs), holds the promise of inculcating the principles of cooperatives that appear to elude members.

The government’s renewed focus on agricultural development, could also help to revamp the rural economy upon which the micro-finance industry is supposed to thrive.

Comments