Opinions

Carbon Market Expert Welcomes a Turf Regulation by IFRS On Climate Action Reporting by Financial Institutions!

IFRS- Stands for International Financial Reporting standards and it plays a vital role in finance by providing clear and consistent guidelines for financial reporting.

This consistency enhances the reliability of financial data, supporting better financial analysis and decision-making. IFRS Accounting Standards provide one common reporting language—a high-quality, internationally recognized set of accounting standards that enable companies to provide efficient, cost-effective reporting that meets investors’ needs.

IFRS Accounting Standards bring transparency by enhancing the quality of financial information, enabling investors and other market participants to make informed economic decisions, strengthen accountability by reducing the information gap between investors and companies; and boost economic efficiency by helping investors to assess potential investments across the world, thus allocating capital to the most promising organizations.

2025- The IFRS Foundation is providing high-level overview of the regulatory approach and the jurisdiction has proposed or indicated it intends to take for the adoption or other use of ISSB Standards (including local sustainability-related disclosure requirements (or standards) designed to deliver functionally aligned outcomes to those resulting from the application of IFRS S1 and IFRS S2). IFRS S1 stands for general requirements for disclosure of Sustainability-related Financial Information and IFRS S2 stands for climate-related disclosures.

IRFS has issued turf but necessary reporting requirements and to start with is the voluntary reporting that is permitted for all entities for fiscal years beginning on or after 1 January 2026 and Mandatory reporting for fiscal years beginning on or after 1 January 2028. The listed entities must comply and these include all financial institutions, micro-finance deposit-taking institutions, insurance and reinsurance entities, savings and credit cooperative organizations qualifying to be public interest entities and public utility entities that apply IFRS Accounting Standards.

Mandatory reporting for fiscal years beginning on or after 1 January 2029 by retirement benefit schemes, large companies and other public interest entities not referred to above. Mandatory reporting for fiscal years beginning on or after 1 January 2030 by small and medium enterprises.

The regulation requires an entity that meets at least two of the following criteria, voluntary savings of three billion (3,000,000,000) Uganda shillings and above, with institutional capital of one billion (1,000,000,000) Uganda shillings and above or membership of 500 people and above and a thresh hold has been set for SMEs and Large Organizations.

The Voluntary reporter’s road-map has been given as follows, 2027 permitted to obtain limited assurance on sustainability- related disclosures excluding Scope 3 greenhouse gas emissions, scenario analysis and transition plans, 2028: permitted to obtain reasonable assurance on sustainability- related disclosures excluding Scope 3 greenhouse gas emissions, scenario analysis and transition plans, 2029: permitted to obtain reasonable assurance for sustainability- related disclosures other than Scope 3 greenhouse gas emissions, for which limited assurance is permitted and mandatory reporters includes financial institutions, insurance and reinsurance, savings and credit cooperatives, public utilities and the road map has been issued as indicated; 2029:

required to obtain limited assurance on sustainability-related disclosures excluding Scope 3 greenhouse gas emissions, scenario analysis and transition plans, 2030: required to obtain reasonable assurance on sustainability- related disclosures excluding Scope 3 greenhouse gas emissions, scenario analysis and transition plans, 2031: required to obtain reasonable assurance for sustainability- related disclosures other than Scope 3 greenhouse gas emissions, for which limited assurance is permitted.

Now what is scope 1, 2 and 3? Essentially, scope 1 are those direct emissions majory C02 and methane that are owned or controlled by a company whereas scope 2 and 3 are indirect emissions as a consequence of the activities of the company but occur from sources not owned or controlled by it.

The total global green gas house emissions are expected to reach 41.6 billion tonnes in 2025 and fossil fuel (Oil products) CO2 emissions contributes 37.4 billion tonnes. Since Uganda is ranked 12th most vulnerable country to climate change and 163rd in un-prepared out of 192 countries, the country needs 28.9 bn USD by 2030 to implement its updated Nationally Determined Contributions (NDCs) to tackle climate mitigation , adaptation and cross cutting climate change disasters.

Economically, the regulation and the road map is an important tool and enabler to strengthening the carbon market for Uganda and globally. Jurisdictions with carbon pricing mechanisms now represent 54% of global GDP and any company to participate in carbon market must have carried an annual carbon footprint lifecycle audits (scope 1, 2 and 3) to assess its emission levels and thus relevant government bodies will have no choice to implement carbon emission quarter system for companies and provide incentives to those that comply and penalties to those that are in default on compliance. Once a company has known its emission.

it will put in place mechanism and strategies to reduce its emission levels and such reduction will create carbon credits that are verified, certified and tradable on the carbon market whether local or international. Defaulting companies must buy carbon credits from complying institutions to avoid heavy penalties that can increase cost of production and subsequent high product or service prices and thus being not competitive on the market.

The regulation will motivate companies to invest in clean development mechanism, support communities to plant more trees to own carbon credits and more of carbon credits profit sharing agreements shall be achieved while contributing to SDG No. 1, No Poverty. Uganda has just launched her carbon market regulation framework and companies will have an opportunity to sell and buy carbon credits through voluntary and regulatory carbon market.

Financial institutions in Uganda will strive to become carbon neutral through offsets. It’s every client’s desire to support low carbon institutions, products and systems. We are going to see responsible and sustainable organizations in a near future. Individual people can also become carbon neutral by reducing personal emission factors and families should transit to clean cooking technology because use of charcoal during cooking contributes to high emission , trees have be cut and remember trees are crucial in Carbon capture and they also load carbon that is desirable in the horizon layer.

In conclusion, implementation of IRFS –S1 & S2 will re- engineer the carbon market trading system in Uganda and today one metric tonne of Carbon credit stands between 7-10 US -dollars but with the implementation of this regulation, It is projected to go up to 14-16 US –Dollars per metric tonne . It’s projected that the implementation will create many carbon credit buyers, sellers and thus generate revenue and taxes to support our GDP with over 15-20 percent by 2030.

It is further recommended that financial institutions, SMEs and large Organizations should start investing in capacity building in respect to carbon literacy professional certifications, create capacity in Carbon footprint reporting and disclosures . Institutions like Bank of Uganda , CPAU , URSB , PSFU , Uganda Manufacturers Association , the Bankers Association , Ministry of trade , Industry and Cooperatives should establish a compliance framework for supervised or affiliated institutions and foster a 360 degrees approach to carbon market for climate action, Market competitiveness and sustainability . I am a proud carbon credit farmer.

For God and My environment.

Call the writer for support in Carbon footprint life cycle Audits (scope 1, 2, and 3), carbon literacy & ESG certifications . The writer was a keynote speaker at the July 07th UN International Cooperatives day on Climate finance opportunities for Cooperatives and has been listed as a key note speaker at the forthcoming Carbon market –Africa Summit in South Africa Johannesburg for Oct -2025 & he is a lead consultant on Uganda’s Climate Finance land-scape mapping report 2015-2025.

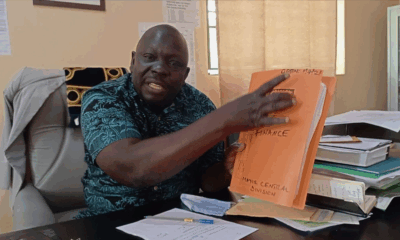

Denis Tukahikaho. PhD is the Executive Director Partnerships & Stake holder Engagements. Climate Hub International. Carbon Literacy Expert (CLE –Manchester) & ESG Professional (Frankfurt)

denis.tukahikaho@climatehubinternational.com

+256 777 222 732

Comments