Agriculture

Pride Bank Honored with Agri-Finance Award for Transforming Uganda’s Agricultural Credit Landscape

Pride Bank Limited has been awarded the coveted Agri-Finance Award (Credit Finance) at the 2025 Annual Agricultural Awards, cementing its position as a trailblazer in Uganda’s agricultural transformation. The ceremony, held under the theme “Celebrating Excellence and Innovation in Agriculture,” brought together key figures from the financial, agricultural, government, and development sectors to honor institutions that are driving real impact in the agricultural space.

Pride Bank was recognized for its exceptional contribution to agricultural financing, particularly its innovative, inclusive, and scalable credit solutions that have strengthened agricultural value chains and improved rural livelihoods across Uganda. The bank’s dedication to reaching underserved communities, providing tailored financial products, and fostering resilience among smallholder farmers distinguished it among this year’s contenders.

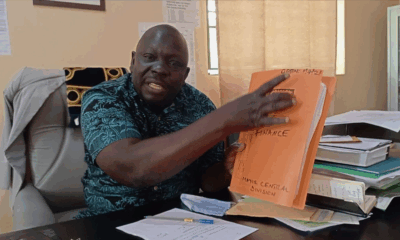

Receiving the award on behalf of the bank, Joseph Kiggundu Lwanga Mugerwa, Manager of Agri-Business and Green Finance at Pride Bank Limited, emphasized the deeper mission behind the recognition. “This recognition is both humbling and affirming. At Pride Bank, our purpose is to transform lives responsibly. Agriculture is the cornerstone of Uganda’s economy, and we have made it a priority to invest in the people who till the land, feed the nation, and drive rural development. This award is a tribute to their resilience, and our shared vision,” he stated.

The award comes after a standout year for the bank in agricultural lending. In 2024 alone, Pride Bank disbursed over Shs62 billion in agricultural loans, directly supporting more than 13,000 clients across the entire agricultural value chain—from production and processing to marketing. The institution’s flagship product, the Pride Agricultural Loan, continues to empower farmers with affordable credit, flexible repayment terms, and essential financial literacy.

What sets Pride Bank apart is its holistic, value chain-based financing model. Rather than offering isolated credit, the bank connects producers to processors and markets, creating a comprehensive ecosystem that helps mitigate production risks, stabilize cash flows, and promote long-term sustainability. Its partnerships with farmer cooperatives, SACCOs, and agricultural extension workers extend this impact further, offering support systems that nurture rural entrepreneurship beyond capital injection.

In addition to its strong field presence, the bank has integrated digital innovation into its service delivery. Farmers in remote areas now access loans, check balances, and make repayments through mobile banking platforms, agent networks, and USSD codes, significantly reducing access barriers and enhancing financial inclusion.

The Ministry of Agriculture, Animal Industry and Fisheries, represented at the event by Commissioner for Crop Resources, Steven Byantware, lauded the bank’s efforts. “Pride Bank’s accessible credit systems are not only strengthening Uganda’s rural economy, but also aligning with national goals under Vision 2040 and the Fourth National Development Plan,” he remarked.

As Uganda intensifies its focus on agriculture as a priority sector for inclusive economic growth, Pride Bank’s recognition reaffirms its role as a reliable partner for farmers and agribusinesses seeking sustainable expansion. The Agri-Finance Award does not just celebrate the bank’s past success—it signals a future where innovative finance drives agricultural prosperity.

With its customer-centric approach, strong partnerships, and digital-first strategy, Pride Bank continues to lead the charge in delivering finance that feeds the nation—one farm, one farmer, and one harvest at a time.

Comments