Economy

Uganda Secures USD 150 Million from BADEA to Supercharge Private Sector Growth

Uganda has secured a major boost to its economic transformation efforts with the signing of a USD 150 million (approx. UGX 537 billion) financing agreement with the Arab Bank for Economic Development in Africa (BADEA). The funds are earmarked specifically to empower the country’s private sector—the backbone of its economy—marking a significant milestone in Uganda’s drive toward inclusive and sustainable growth.

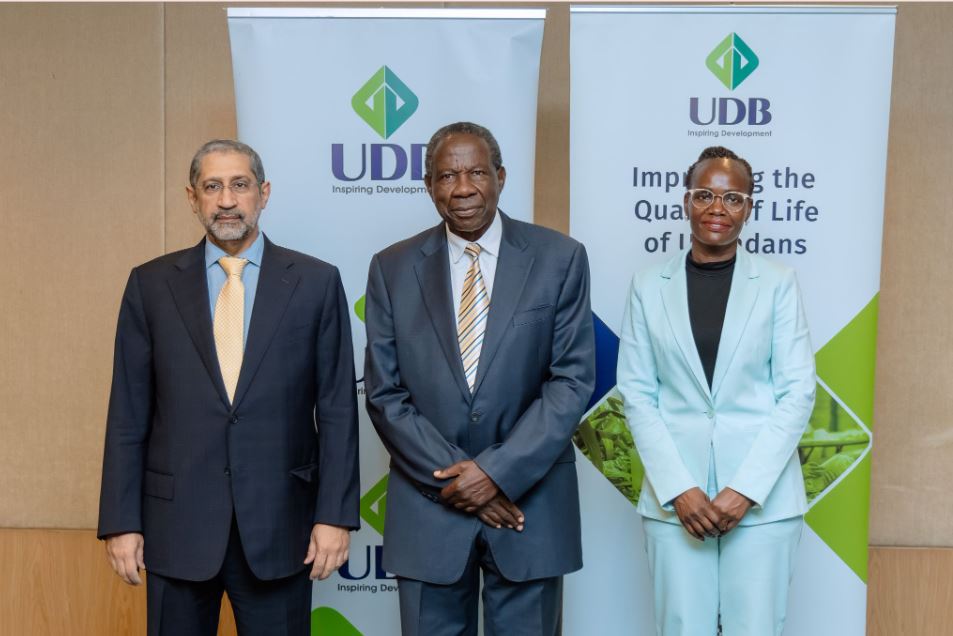

The agreement was officially signed today on the sidelines of the 41st Board of Governors Meeting of the Trade and Development Bank Group (TDB Group) in Kigali, Rwanda. The signing ceremony brought together key figures, including BADEA President H.E. Abdullah Almusabeeh, Uganda’s Minister of Finance, Planning and Economic Development Hon. Matia Kasaija, and Uganda Development Bank (UDB) Managing Director Dr. Patricia Ojangole.

A substantial USD 100 million of the total package has been secured by the Government of Uganda under BADEA’s Private Sector window, and will be disbursed through Uganda Development Bank Limited (UDB)—the country’s national development finance institution. This capital injection is set to unlock new opportunities for businesses across priority sectors such as agro-processing, manufacturing, infrastructure, health, and education.

“This funding will allow UDB to significantly scale its lending to high-impact sectors that are essential to Uganda’s economic development,” said Minister Kasaija. “We are particularly focused on stimulating industrialisation, improving productivity, and creating jobs.”

Uganda’s private sector contributes approximately 80% of the national GDP and employs the majority of the non-farm workforce. Yet, access to affordable, long-term capital remains a key constraint—especially for Micro, Small, and Medium Enterprises (MSMEs), which make up over 90% of the private sector. The UDB facility aims to close this financing gap by providing the kind of patient capital that commercial banks are often reluctant to offer.

BADEA President H.E. Abdullah described the agreement as a model for public-private collaboration in development finance. “Today’s agreement demonstrates how governments can effectively leverage BADEA’s financial instruments across public, private, and trade finance windows to fuel economic transformation,” he said.

He further noted that the BADEA Private Sector window is designed not only to support governments but also to directly or indirectly finance private entities—enabling strategic industries to expand, improve competitiveness, and increase GDP contributions.

UDB, which has previously worked with BADEA on several credit lines, will use the new funding to extend loans to enterprises in value addition, industrial development, and social services. The support is expected to help: Bridge financing gaps in underserved sectors. Stimulate job creation through business expansion. Improve productivity and efficiency through investment in modern technology. Drive inclusive growth by targeting MSMEs and businesses outside major urban centres

The remaining USD 50 million of the BADEA facility will be directed toward other forms of private sector development, potentially including direct investments or trade finance, offering additional liquidity and capital for businesses seeking to expand into regional and international markets.

Dr. Patricia Ojangole, UDB Managing Director, welcomed the funding as a critical boost to the Bank’s mandate. “This facility significantly strengthens our capacity to serve Uganda’s private sector with long-term, affordable capital. It is a vote of confidence in our institution and in Uganda’s broader economic agenda,” she said.

As Uganda implements its Third National Development Plan (NDPIII)—which prioritises industrialisation, export promotion, and private sector-led growth—this strategic partnership with BADEA positions the country to make significant strides in achieving sustainable economic transformation.

The facility not only reflects Uganda’s growing ability to attract international development finance, but also signals renewed global confidence in its investment climate and governance framework. For Uganda’s entrepreneurs, manufacturers, and innovators, this funding opens the door to new possibilities, with the potential to reshape the economic landscape for years to come.

Comments