Analysis

The National BURDEN; Uganda’s Budget swells by Ushs9 trillion in one year

The government of Uganda will on June 11, as money it needs to operate as well as implement development projects in the coming financial year 2015/16.

The dramatic swelling of the budget from 15.4 trillion in the outgoing year 2014/15 to 23.9 trillion in 2015/16 – an increase of almost 9 trillion shillings, coming especially in an election year, has sent shivers down the spines of some Ugandans, many of whom fear that a huge chunk of the money being demanded by the government is likely to be misused and will distort the economy yet again.

Where will the money come from?

According to the Appropriation bill 2015 that was recently tabled and passed in Parliament, while the government seeks to boost its funding, Uganda Revenue Authority’s revenue collection capacity has not expanded that much.

URA is expected to raise some 11.1 trillion next financial year as compared to its target of 9.5 trillion in the outgoing 2014/15 year. This means that the government will only be able to finance just 44.5% of its budget. The government has made no secret of the fact that the biggest portion of the budget, 55.5% will be borrowed and this has angered many people who argue that the government cannot afford to live beyond its means by borrowing money.

This comes after economists have raised the red flag on Uganda’s debt sustainability levels following the acquisition of loans especially from China to finance several infrastructural projects.

Speaking to Journalists in Parliament this week, Leader of Opposition in Parliament Wafula Oguttu, sarcastically asked where will the government get the rest of the money? He answered himself by noting that the money will come through borrowing.

But the government’s desire to finance its deficit budget through borrowing, Oguttu noted, imposes a needless burden on the shoulders of Ugandans.

A statement published by the Civil Society Budget Advocacy Group, noted that: “Considering that government’s total revenue from both taxes and non-tax revenue is projected to be Ushs11.1trillion, it means, government will be able to fund next year’s budget by only 44.5% and the remaining 55.5% of the budget money will come from external and domestic borrowing from the private sector,”

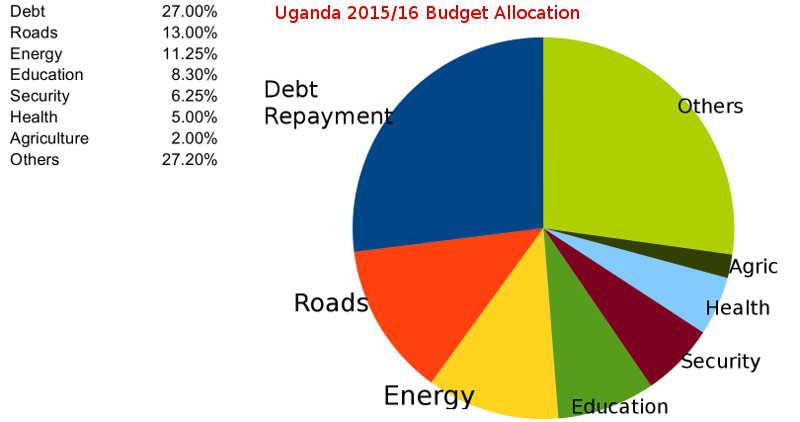

The biggest portion of the budget of Ushs6.4trillion, according to the Appropriation Bill, will go into public debt repayment.

Ushs3.2 trillion will go to works and transport sector, and Ushs2.7 trillion to the energy sector. The Education Sector will get Ushs2trillion, Security and Defence will get Ushs1.5trillion, while health will be allocated Ush1.2trillion.

Leader of Opposition Wafula Oguttu expressed when he noted that State House is set to take over one trillion shilling, more than double the amount budgeted for agriculture sector, the engine of Uganda’s economy. In the new budget, the agriculture sector, which supports majority of Ugandans will get just Ushs484.6b, less than 3 percent of the total budget.

The Civil Society Budget Advocacy group, which brings together NGOs such as SEATINI, ActionAid and Anti-Corruption Coalition Uganda (ACCU), adds: “This is a decline in government financing of its national budget considering that in the most recent financial years, government has funded more than 50% of its national budget.”

In fact according to Minister Matia Kasaija, a significant portion of the budget – almost six trillion – is money that has already been borrowed from abroad, including the Ushs4 trillion that was approved by Parliament to finance Karuma dam.

While the government claims that a lot of the money borrowed is meant to put in place crucial infrastructure projects such as for energy, many experts have reservations about the scale of borrowing but more also the inefficient use of borrowed money.

Civil Society Activists say that huge sums of money but especially its misuse, as seen in several corruption scandals and well as cowboy development projects such as the recently built markets which have cracked almost immediately after being launched, represents an unacceptable burden that is placed on the shoulders of Ugandans.

Experts and financial monitoring agencies such as the World bank and the International Monetary Fund have criticised continued borrowing of money without building sufficient capacity to utilise the funds.

Only recently, the Permanent Secretary in the Ministry of Finance Keith Muhakanizi revealed that as much as seven trillion shillings of borrowed money was lying unused on government consolidated fund, due to lack of sufficient absorption capacity.

The Civil Society Budget Advocacy Group has also likened the coming budget to a return to the 1990s when the government had to depend on foreign borrowing to finance its budget.

Godber Tumushabe, Associate Director of Great Lakes Institute for Strategic Studies (GLISS) argues that the new budget is a huge betrayal of Ugandans since it does not provide sufficient funds for what he considers the three crucial sectors that affect majority of Ugandans; I.e Education, Health and Agriculture.

“If only the huge jump in the budget allocation was going to the sectors that affect the ordinary person, it would be fine. But you see the same sectors that have been getting huge allocations year in year out, again featuring this time. You see trillions going to security, State House, Public Administration, Infrastructure which are riddled with corruption and inefficiency,” Tumushabe adds. “On the contrary, the essential sectors such as health and agriculture, have regrettably received lesser percentages.”

In 2001, African governments committed themselves to allocating not less than 15% of their national budgets to health. In 2014 through the Malabo declaration, African governments committed to allocating not less than 10% of their national budget to agriculture.

Tumushabe blames the Ugandan public for looking on when, as he noted, the government continues to disregard the issues that affect them most.

“The other day, teachers were silenced when they demanded an increase in pay with claims that there was no money and they accepted it. But with a single stroke of a pen, MPs increased their own pay, and Ugandans simply looked on,” said Tumushabe.

Tumushabe further blames Members of Parliament for ‘letting down the masses’ by ‘rubber stamping inefficiency’ and failing to put government to task on some of the funding proposals.

Tumushabe dismisses as dishonesty the claim made by the government that infrastructure deserves an increase in allocations.

“Every year, the Uganda National Roads Authority (UNRA) returns money it has not used. This is on top of billions of money that is lost through corruption such as the recent Katosi road project,” Tumushabe told The Sunrise.

He argues that instead of piling debts on Uganda’s future generation, the government would do better to increase the capacity of local firms to be able to build roads and provide employment to nationals than giving the money to foreigners.

“A lot of the construction companies are foreign. The Chinese, Israelis and Turks take the bulk of the money back to their countries. How is that benefiting us?” asked Tumushabe.

For Tumushabe, the forthcoming elections explain the dramatic jump in the government budget.

“I think the coming elections explain the jump from 15 to 24 trillion shillings. They will tell you that money has been allocated to security and roads, but they will go round and use the money for electioneering,” he said.

Ramathan Ggoobi, a lecturer at Makerere University Business School agrees with Tumushabe. He says that in fact there is consistent pattern showing government exponentially increasing its budgetary expenditure in an election year.

“Research shows that in the face increased fiscal scrutiny, incumbent politicians tend to use budget instruments for re-election. Now that the BOU [Bank of Uganda] has been categorically clear it won’t finance elections, the executive has resorted to fiscal policy, through increased public spending, to satisfy the “median voter” in total disregard of the potential adverse effects on fiscal sustainability and macro stability after the election.”

Ggoobi adds that as a result of government’s growing unquenchable thirst for cash to spend for electioneering purposes, Ugandans should brace for higher taxes to repay the debts.

“Ugandans should simply tighten their belts because immediately after the election, taxes will be revised upward to finance the deficits and repay the public debt that is rapidly growing, although authorities are saying it is still sustainable,” said Ggoobi.

Ggoobi predicts that in the subsequent fiscal year 2016/17, interest rates will rise or keep high which will crowd out private investment. Crowding out the private sector refers to a situation where commercial banks prefer to lend to the government by buying more secure and usually very lucrative bonds and treasury bills, instead of lending to the private sector.

“As a result, less jobs will be created, inflation might rise and the general business environment negatively affected. That’s what we call the fiscal effects of election cycles.”

Comments