News

Information gaps hindering company expansion using capital markets

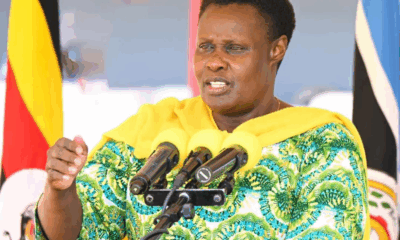

Minister for Finance Matia Kasaija

Majority of Ugandan business people are not aware of the fact that they could acquire capital to grow their businesses by using capital markets.

As a result, many companies have been forced to go to banks to borrow money at exorbitant rates from commercial banks, or perhaps fail altogether to raise capital, especially those that need long term financing.

This view was expressed by the Minister of Finance and Economic Development Matia Kasaija while officiating at a one-day meeting that was organised by the International Finance Corporation (IFC), a branch of the World Bank group, to tackle challenges in Uganda’s debt market.

Debt markets are virtual markets where companies and the government can raise money by issuing investors guarantees to repay the money at a future point in time and at a fixed interest rate.

Some examples of debt instruments are government and corporate bonds, which can be traded on the securities exchange.

Minister Kasaija’s view was reinforced by other speakers at the conference who noted that lack of information is contributing to the prevalence of poor corporate governance as entrepreneurs don’t readily see the value of putting in place systems that ensure transparency beyond serving them.

Paul Bwiso, the Chief Executive Officer of the Uganda Securities exchange, revealed that they tried to approach some companies to interest them into raising capital by issuing corporate bonds, but majority opted to go to banks to borrow instead of tapping into cheaper and longer term financing afforded by the debt market.

Although some participants cited the stiff regulatory requirements for a company to be able to access money through capital markets, some attributed this sentiment to the lack of deliberate efforts by relevant players to develop a culture of transparency among entrepreneurs, a key factor in attracting investors in a company.

Besides, poor information, high levels of government borrowing witnessed in Uganda in recent years that led to government paying very high interest rates on bonds , was cited as another obstacle to companies as banks prefer to lend to government than private companies.

IFC, which brings together a number of international investors, supported the workshop to sensitize stakeholders on the opportunities available through vibrant local currency capital markets.

IFC Vice President and Treasurer, John Gandolfo said: “Deep, vibrant local capital markets are essential for a thriving private sector that creates jobs, innovation, and sustainable economic growth. Developing a liquid, structured bond market in Uganda can provide access to long-term, local currency financing for vital infrastructure, help reduce foreign exchange risks, and diversify sources of funding.”

Since establishment the Capital markets Authority(CMA) of Uganda has witnessed nine corporate bonds being issued in Uganda raising a combined capital worth UGX288bn. Majority of the issuers are banks with a few others being MTN, Kakira sugar.

Comments