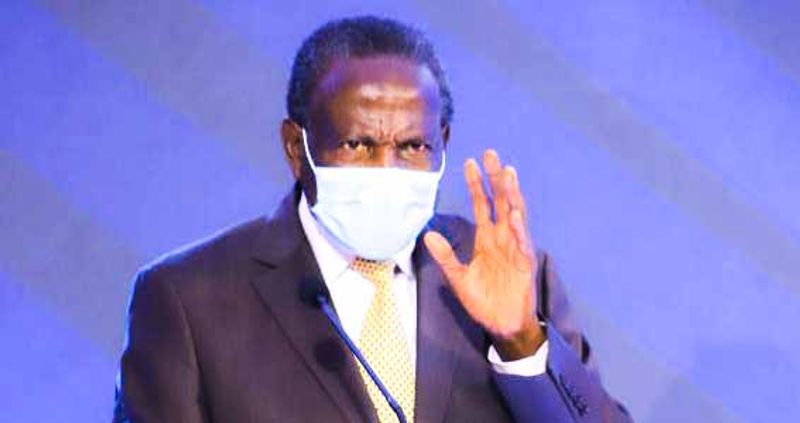

Finance Minister Matia Kasaija

Members of the National Social Security Fund (NSSF) will receive a higher return on their savers compared to what they got last financial year.

The Minister of Finance, Planning and Economic Development, Matia Kasaija, announced a 12.15% on member savings for financial year 2020/2021.

This was during the Fund’s 9th Annual Members Meeting held at Kampala Serena Hotel on Thursday.

The rate declared translates into a total of UGX1.52 trillion that will be credited to the members’ accounts, higher than the UGX1.14 trillion that was paid to members in the previous financial year.

“As provided for in the NSSF Act, this new rate will be calculated and credited on the balance outstanding on the members’ accounts as of 1st July 2020,” Kasaija said after announcing the interest rate.

The 12.15% interest rate that is higher than the 10.75% interest rate declared last financial year demonstrates the Fund’s resilience to withstand shocks occasioned by a stressed economy and uncertain business environment.

”The performance as presented by the NSSF MD and Chairman is commendable given that the COVID-19 pandemic has had massive economic and social effects across the globe. Uganda was no exception, with the economy growing at 3.3% in the financial year 2020 to 2021. To register any growth is therefore very commendable,” Kasaija added.

Performance highlights indicate that the Fund’s assets increased by 17% from UGX13.3 trillion to UGX15.5 trillion and comprehensive income increased by 25% from UGX 1.47 trillion to UGX 1.84 trillion.

“The growth in income interest can be attributed to the increased return on Treasury Bonds in the Fixed Income portfolio, dividend income, and property sales,” Richard Byarugaba, NSSF Managing Director said while presenting the performance highlights at the annual members meeting.

Dr. Peter Kimbowa, the newly appointed Chairman Board of Directors, reassured members that the Fund would continue to create value for them and give them a good return higher than the ten-year inflation rate.

“ As a new board, our focus for this financial year will be majorly to conclude legislative reforms, ensure prudent investments and to ensure that our staff are prepared for a different operating environment that will be ushered in by the legislative reforms. “ he said.

The 12.15% interest rate declared is above the 10 years average rate of inflation which currently stands at 5.43%

The Assets under Management increased by 17% from UGX 13.3 trillion to UGX 15.5 trillion as of June 30, 2021, driven by increased contributions and interest income.

The Total Comprehensive Income increased by 25% from UGX 1.472 trillion to UGX 1.84 trillion, driven by growth in interest income attributed to the increase in return on Treasury Bonds in the Fixed Income portfolio, increase in dividend income, and property sales.

Member contributions increased by 8% from UGX 1.27 trillion to UGX 1.37 trillion.

Byarugaba said, this is better than a marginal percentage growth of 5% recorded the year before. The growth is attributed to the recovery of some employers that has benefited from the Fund Amnesty we offered to business that were affected by the COVID-19 pandemic in the previous year.

Benefits paid to qualifying members increased by 29% from UGX 496.4 billion in 2019/2020 to UGX 642.3 billion in 2020/21. The growth is attributed to an increase in number of claimants and the introduction of IB payments for the COVID-19 patients.

Byarugaba said the fund has lowered it’s costs of operation and administration from 1.20% in 2019/2020 to 1.03% in 2020/2021.

Musa Asiimwe

Leave a Comment

Your email address will not be published.