The government has proposed yet another tax exemption to the Bujagali Hydropower Project that will see the power producer relieved of the burden up to 30 June 2032.

The proposal is contained in the Income Tax (Amendment) Bill, 2025, which was tabled for its first reading by the Minister of State, Finance, Planning and Economic Development (General Duties), Hon. Henry Musasizi.

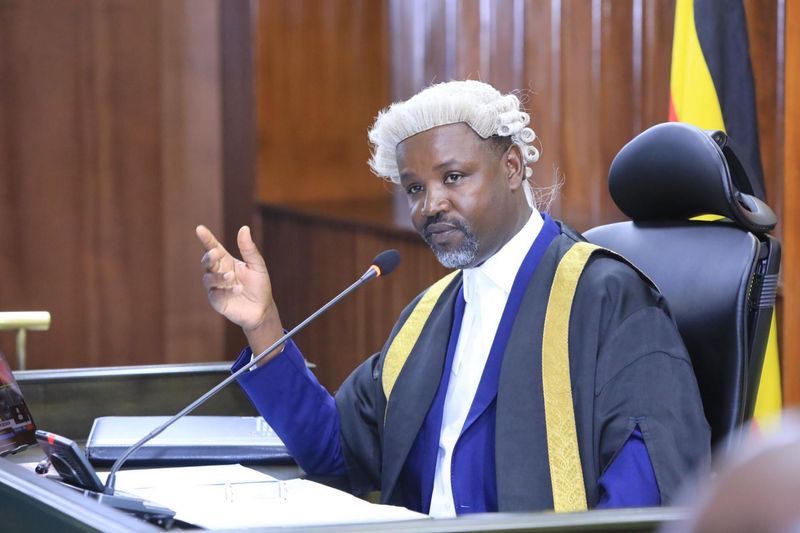

The Bill was tabled during a plenary sitting, chaired by Deputy Speaker, Thomas Tayebwa, on Thursday, 27 March 2025.

Last month, the same Minister tabled the same Bill, seeking to extend the tax exemption to the power company up to 30 June this year.

Subsequently, Musasizi appeared before the finance committee, where the lawmakers raised concerns about Bujagali Energy Limited’s management of preferential shares, arguing that the redemption of these shares had led to financial losses for Uganda.

Between 2018 and 2021, the government granted the power company similar tax exemptions. However, in 2023, Parliament rejected the request by government to award Bujagali another five-year tax exemption.

Meanwhile, the proposed amendments to the Income Tax Bill, 2025, also include the exemption of startup businesses established by a citizen for a period of three years from tax.

This exemption, the minister justified, is aimed at encouraging entrepreneurship, supporting small and medium enterprises and stimulating innovation.

Relatedly, the Government has proposed exempting textile inputs from Value Added Tax (VAT).

This proposal is contained in the Value Added Tax (Amendment) Bill 2025, which was also tabled for its first reading during the same sitting.

The Bill, tabled by Musasizi, outlines the textile inputs for exemption as wet processing operations and garmenting, cotton lint, artificial fibres for blending, polyester staple fibre and viscose.

Others include textile dyes and chemicals, garment accessories, textile machinery spare parts, industrial consumables for textile production and textile manufacturing machinery and equipment.

The proposed amendments in the Bill will further see solar lanterns exempted from VAT, and such products include deep cycle batteries, solar lanterns and raw materials for the manufacture of deep cycle batteries and solar lanterns.

“The repeal of the VAT exemption on billets is intended to boost local production, reduce reliance on imports, and advance Uganda’s industrialisation agenda,” said Musasizi.

He added, “By supporting domestic manufacturing, this measure is expected to create jobs, enhance value addition, and stimulate economic growth.”

Bio-mas pellets have also been lined up for VAT exemption, with the justification that this will promote environmental sustainability by encouraging the adoption of cleaner, energy-efficient cooking and heating solutions, reducing reliance on traditional biomass fuels.

Further to that, aircraft supply is expected to be zero-rated once the proposed amendment is adopted.

The proposed amendments also introduce the anti-fragmentation rule, a move the Minister said aims to combat tax evasion by preventing importers from intentionally splitting consignments to remain below the VAT registration threshold.

“This measure is expected to enhance tax administration, improve revenue collection, and strengthen Uganda’s VAT compliance framework,” said Musasizi.

Under the proposed amendments, United Nations-related agencies and specialised agencies will be designated as listed institutions.

Sunrise Reporter

Leave a Comment

Your email address will not be published.