At this rate we might get to February when we are supposed to vote when the exchange rate is Ushs.5, 000 per U.S. dollar!

Mr. President, I know this is not good for your ongoing campaign to extend your stay at Entebbe and Nakasero to 35 years. However, far from deliberately working to send you back to the village, I am going to say the hard truth about what is going on in our economy. And trust me it will have no effect on the likely outcome of the 2016 general elections. Ugandans do not vote for the same reasons that take people elsewhere to the polling stations.

Let me state upfront that you and your former friend Amama Mbabazi are swiftly taking this country where you picked it in 1986. Every day that passes, your exchanges and actions, and the follow up exchanges and actions of your hangers-on are making every single Ugandan and foreign investor scared to the marrow. These are very bad times for our country.

But what haven’t I written about before? This week I did not pick my pen and paper to extend the lamentation. I picked them to tell you how and why the shilling is at the verge of collapse, again as it did in the 1980s.

This week, Bank of Uganda Governor, Emmanuel Tumusiime-Mutebile, issued a statement, albeit through a speech to Uganda Manufacturers’ Association, and clearly told the world that the central bank has given up on the shilling.

“It is not sustainable for the Bank of Uganda to try and prop up the exchange rate, at levels which are not consistent with supply and demand in the foreign exchange market, by intervening and selling foreign currency. The BOU would simply deplete its foreign exchange reserves if it attempted to do this,” Mutebile said.

BOU stops intervention

That statement, honest as it may be, was a blow to the already weak shilling. Mutebile made the statement on July 2, 2015. In the preceding days, before Mutebile’s announcement, the shilling was depreciating at a daily average rate of about Ushs.16. After July 2, the shilling has deprecated at a daily average rate of about Ushs.70.

Indeed the rapid depreciation of the shilling after July 2 must have exerted massive pressure on the authorities at BOU, which forced Mutebile to eat his words and inject some dollars in the market to arrest the situation that was getting out of hand. The rate had reached Ushs.3,800 on Thursday July 9.

Although attributing the rapid post-July 2 rapid deprecation to Mutebile’s announcement would be simplistic, especially since I have not tested for causality, the fact is that at the ongoing rate the shilling is headed for collapse.

Yet Bank of Uganda’s decision to stop intervening in the market is the right decision. The market fundamentals and market expectations in Uganda dictate that the shilling should depreciate until the equilibrium is met, but BOU has been keeping its value artificially high through interventions.

A senior colleague, one of the best trained macroeconomists in this country, and I, have for months now been investigating Uganda’s foreign exchange rate movements in the last two decades with a view to establish their underpinnings and suggest policy recommendations for the authorities. We are about to publish our findings.

However, I recently gave Bank of Uganda and IMF officials some of our preliminary findings. I let them know that by depleting reserves to keep the shilling afloat, BOU had become predictable to speculators and it was actually donating them our scarce resources.

Open capital account

Our research shows that since the liberalisation of the foreign exchange markets in 1993, and the subsequent decision by the BOU to intervene in the FX markets, first through sterilized and later unsterilized interventions after the adoption of inflation targeting in July 2011, periods of sharp depreciations are often followed by sharp, though sporadic, appreciation. This clearly shows that BOU’s participation in the market had become predictable to speculators who were quick to pounce on the dollars sold by the bank.

When we raised this fact, representatives of Bank of Uganda were quick to respond that their intervention in the FX market neither seeks appreciation nor depreciation. “Our intervention seeks to smoothen out undue spikes in the exchange rate,” they said. Of course that is the textbook; unfortunately empirical evidence shows something different. Our research clearly shows that sharp depreciation is followed by sharp appreciation, meaning that the movements are artificial.

Nevertheless, the BOU is not to blame for the ongoing crisis in Uganda’s FX markets. That is the very point I started this article with. Where the BOU need to share blame is its insistence on unsterilized intervention and the single monetary policy mandate of targeting inflation they pursue, as if it is all what matters in an economy as small as Uganda’s.

Why should someone insist on a monetary policy that they know cannot work because it is being contradicted by an uncoordinated fiscal policy? How can one expect to “smoothen out undue spikes in the exchange rate” in an economy whose capital account is fully open? Now it is election time, and we know ours is always chaotic, how do they expect to avoid capital flight when our capital account is wide open?

Expansionary Fiscal Policy

The problem with Uganda’s economists, both at BOU and at Ministry of Finance, is wanting to respectively be more monetarist and Keynesians than Milton Friedman and John Keynes. When Mutebile and his team at BOU were asked to open the capital account, they took it literally to mean there should not be any control. So to them opening up meant plucking out the door altogether. Money can freely come in and exit at the slightest signal of risk. Every time we have election, the shilling loses nearly 20% of its value.

At Finance, when Keith Muhakanizi and his team were asked to support the economy by increasing spending on infrastructure (expansionary fiscal policy), they took it literally to mean that is the sole multiplier for stimulation of economic growth. They got all roads around the country and put them in the budget, to be built on borrowed money.

When people asked them why they were not sequencing the roads such that they could cater for absorptive capacity, and also have some money to spend on other important things such as agriculture modernization, tourism, and other forex earners, the Muhakanizis reasoned that money spent on roads was also money spent on agriculture and tourism.

Their reasoning was that good roads would stimulate the two sectors. Very pedestrian reasoning! Greece is in a crisis yet it has first class infrastructure. Why? Roads, bridges, power lines etc. are non-tradables. You cannot export a road to earn the dollar. Fine, the roads are important, so invest in them but don’t overdo it to the extent of failing to spare money to invest in the sectors that produce tradables.

At BOU, although the generic factors that they loves to outline — the strength of the dollar, weak global economy, low export performance, low remittances, and low foreign direct investment (FDI) inflow — might have contributed to the ongoing obscene depreciation of the shilling, in my view most of these factors secondary in explaining the current situation. The primary cause is the political uncertainty that has been created by the apparent power struggles within NRM.

Very scary times

Mr. President, I have on several occasions warned that political uncertainty ahead of 2016 might return the economy to the post 2011 crisis. The ongoing political bickering between you Mbabazi is spoiling the achievements both of you had brought to this country.

Investors are reluctant to bring their dollars in a country where the former Prime Minister is threatening to jump over police mambas. Secondly, the few investors that had brought in some dollars are packing their bags, of course full of the dollars, to leave the unsafe country. This has left the economy with very few dollars yet demand for them to import goods, and construction materials, is rising. This situation is likely to get worse as we approach 2016 general election. Hopefully the election will take place.

The rate at which the exchange rates are depreciating is scary. We might reach February, when we are supposed to vote, when the rate is Ushs.5,000 or even more. Yet in 1987 we carried out a currency reform by knocking two zeroes off the currency. My old Professor recently told me, in order to fairly assess the shilling performance under the NRM rule we should reinstate the two zeroes to the exchange rate today.

In other words, had the NRM not “stolen” the two zeroes off the currency, the exchange rate today would be Ushs.360,000 per U.S. dollar! On a serious note Mr. President, consider taking some radical steps to save the shilling and the economy. These are indeed very scary times for Ugandans.

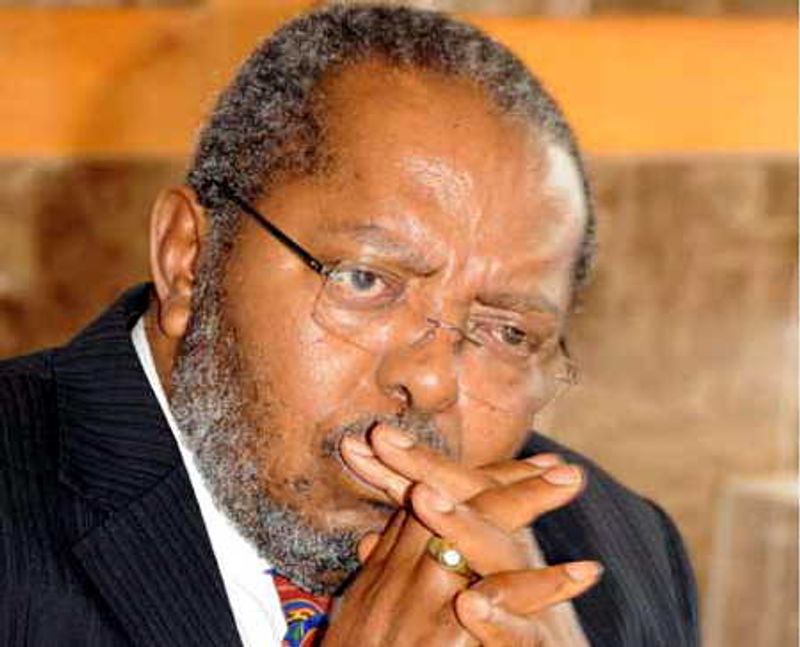

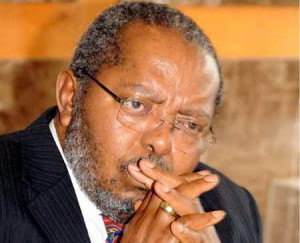

Ramathan Ggoobi

Ramathan Ggoobi is Policy Analyst, and Researcher. He lecturers economics at Makerere University Business School (MUBS) and has co-authored several studies on Uganda's economy. For the past ten years, he has published a weekly column 'Are You Listening Mr. President' in The Sunrise Newspaper, Uganda's Leading Weekly

Leave a Comment

Your email address will not be published.