Business

Islamic banking kicks off as Salaam bank gets 1st license

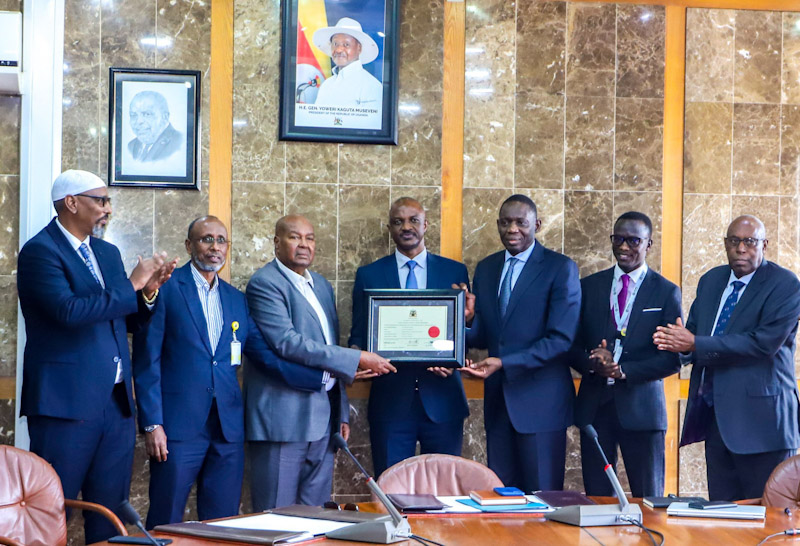

BoU board members handing out the first Islamic banking license to Salaam Bank ltd

Islamic banking has at long land got the green light to operate after the Bank of Uganda granted its first Islamic banking license to Salaam Bank Limited.

Deputy Governor, Bank of Uganda, Mr. Michael Atingi-Ego, flanked by other Board Members of Bank of Uganda, handed over the license to the directors of Salaam Bank at Bank of Uganda Board Room on Friday September 8, 2023.

Dr. Atingi-Ego said: “The BoU is committed to providing oversight and support to Salaam Bank Limited as it embarks on this new journey. Islamic banking has the potential to make a significant contribution to the development of Uganda’s financial sector.”

The award of the first Islamic banking license comes in the wake of the presidential assent to the enactment of the Income Tax Amendment Bill No.2 of 2023 which cleared all legal roadblocks to the commencement of Islamic banking products in Uganda.

The Islamic Finance measures, considered long-overdue by many Ugandans, had been given the green light as far back as 2014 but lacked supporting regulations.

The award of the license, will not only give a boost to the less known Salaam bank ltd in Uganda, but will also bring new competition in the market as other financial institutions will likely want to offer similar products to avoid losing customers.

Technical issues such as defining interest, partnerships had held the introduction of regulations to govern Islamic finance in Uganda.

But with the assistance of MPs such as Muhammad Muwanga Kivumbi, the definitions were ironed out.

For exampple, partnership was amended to read, “…association of persons carrying on business for joint profit, that includes an equity of partnership financing under Islamic financial business.”

The law also permits Islamic Insurance to be introduced.

Islamic insurance, known as ‘takaful’, an Arabic word that means ‘guaranteeing each other’, denotes insurance based on Islamic jurisprudence.

Reinsurance, which in Islamic banking terms is re-takaful, is also provided for in the amendment.

Section 67 of the principle Act is amended to create an obligation to withhold tax on the part of a non-resident partner under Islamic partnership as is required of any other taxpayer.

The removal of roadblocks has attracted praises from some muslim legislators.

Asuman Basalirwa (Jeema, Bugiri Municipality)said the law will pave the way for the introduction of Islamic law compliant banking products.

What is Islamic banking?

According to a recent report by Bank of Uganda’s supervision department: “Islamic Banking is a banking system based on the principles of Islamic or Sharia law. It is underpinned in application by concepts derived from the Quran and the writings of Islamic scholars. These concepts revolve around the value of a sound currency and fairness in transactional dealings, the latter being structured within the bounds of Sharia law. Parties to any transaction in this banking system are obliged to conduct their business affairs, with a focus on what is permissible and lawful under Sharia law.

As indicated earlier, Islamic banking transactions are guided by morals and value system as derived from Sharia Law, and these demand: transparency and full disclosure between parties to a transaction; good faith in conduct by the parties to a transaction; and participation in transactions that do no harm to the wider society. Consequently, transactions in Islamic Banking are often viewed as a culturally distinct but religiously motivated form of ethical investing.

And last but not least, the central premise in Islamic Banking is that money, in of itself has no intrinsic value, but rather it must be used to generate income through trade and / or investment in tangible assets; whence it derives its value. Any gains arising from the trading are shared between the party providing the capital and the one borrowing the money and providing the expertise. In supplement to this fundamental premise, there are four key principles that provide additional anchor for this type of banking, namely:

a) Prohibition of payment and receipt of interest

Interest represents any fixed or guaranteed payment on cash advances or on deposits, therefore representing a sure gain to the lender regardless of the performance of the borrower’s business or commercial undertaking. This is precisely what Islamic Banking prohibits. However, Islamic Banks are permitted to engage in trade and commerce, and the value they create is through the profits earned in trading or participating in other forms of commercial enterprise. But this option is not available to conventional banks, since the value they create is through the earning of interest.

b) Mutuality of risk sharing-profit and loss

In Islamic Banking, the Banks and their customers are partners, and share in a predetermined and agreed ratio, the profits or losses arising from this “joint venture”. This of course demands full disclosure or rather minimal information asymmetry from both the lender and borrower with respect to the said transaction.

c) Prohibition of investment in harmful sectors / Businesses

Islamic Banking integrates Islamic moral and ethical value systems, and as such, prohibits the financing of harmful products and or activities. The definition of what constitutes harmful is derived from Sharia Law, and thus Islamic banks cannot therefore finance businesses such as casinos, nightclubs or any such activity.

d) Prohibition of uncertainty and speculation

There are strict rules in Islamic finance or banking against transactions that are highly uncertain or speculative or that may cause any injustice or deceit against any of the parties. For example: the sale of goods or assets of uncertain quality or delivery or payment; or contracts not drawn out in clear and unambiguous terms; are some of the many transactions prohibited under Islamic banking. This prohibition extends to transactions or contracts where uncertainty is combined with one party taking advantage of the property of the other, or where one party can only benefit when the other party loses. And by extension, speculative transactions are also prohibited since no asset is created.

Comments