Finance and Banking

Absa Group’s New CEO Signals Deeper Commitment to East Africa with Strategic Uganda Visit

Absa Group’s new Chief Executive Officer, Kenny Fihla, has wasted no time establishing a clear direction for the pan-African banking giant, choosing Uganda as one of his first key destinations in a regional roadshow aimed at reinforcing the bank’s commitment to East Africa.

Barely a month into his new role, Fihla’s visit is more than ceremonial—it marks a recalibration of Absa’s strategic priorities toward deeper local engagement, long-term investment, and a reaffirmation of customer-centric banking in high-growth markets like Uganda.

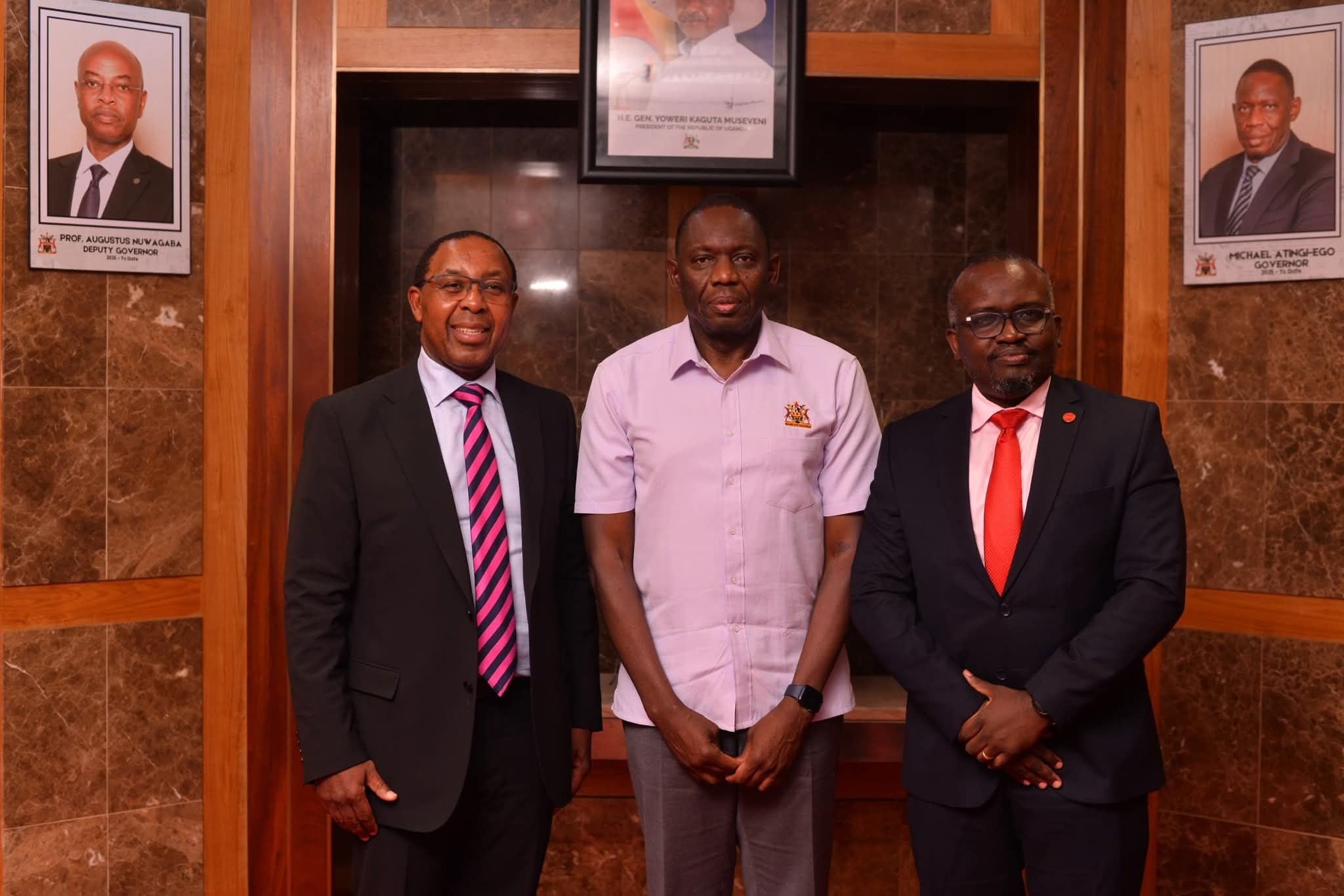

Fihla’s meetings with Uganda’s Finance Minister Matia Kasaija and Bank of Uganda Governor Michael Atingi-Ego demonstrate Absa’s intent to maintain strong institutional relationships while positioning itself as a central partner in Uganda’s economic transformation. The move comes at a time when Uganda’s macroeconomic fundamentals are improving, with GDP growth in FY2024 estimated at 6%—up from 5.3% the year prior—driven by resilience in the agriculture, ICT, energy, tourism, and manufacturing sectors.

From a broader lens, Fihla’s visit is a subtle but significant signal that East Africa is becoming an increasingly critical pillar of Absa Group’s pan-African expansion strategy. The region’s demographic dynamism, improving policy environments, and rising intra-African trade prospects—especially under the African Continental Free Trade Area (AfCFTA)—make countries like Uganda ideal for long-term investment. The emphasis on collaboration with government, clients, and local teams echoes a growing understanding that regional success will not be achieved through capital alone, but through deliberate partnerships and listening to local needs.

Absa Group is also aligning itself with Uganda’s development agenda. The African Development Bank’s 2025 Country Focus Report identifies financial sector stability, a more responsive monetary policy framework, and exchange rate resilience as foundations for sustainable growth. This presents an enabling environment for financial institutions like Absa to innovate responsibly, drive financial inclusion, and support Uganda’s transition to a more digitised, inclusive economy.

By personally engaging with Absa Uganda’s teams and stakeholders, Fihla is showing that leadership at the top must translate to alignment at the operational level. It’s a philosophy that resonates with his message: “Customer centricity is not just a value—it’s a way of working that drives everything we do.”

This commitment is further echoed by David Wandera, Managing Director of Absa Uganda, who noted the visit as a strong signal of Uganda’s strategic relevance to the Group’s future. Under Wandera’s leadership, Absa Uganda has been focusing on digitisation, talent development, and expanding its offerings to serve a broader base of SMEs, corporates, and retail customers.

As East African economies continue to navigate the post-pandemic recovery, the presence of large, stable financial players like Absa can act as both a stabilising force and a catalyst for growth. But the real differentiator, as Fihla’s visit suggests, will be how well banks can adapt their continental ambitions to local realities. From product development to regulatory alignment, and from talent empowerment to sustainable finance, the success of institutions like Absa will depend on their ability to make strategy personal—and local.

In this light, the Uganda leg of Fihla’s roadshow is not just a symbolic stop; it is a foundational step in a broader strategy to build a truly African bank for Africans—one rooted in the realities of Kampala, as much as those of Johannesburg or Nairobi.

If sustained, this momentum could redefine the role of commercial banks not just as lenders, but as long-term partners in national development.

Comments