Financial institutions have been encouraged to prioritize training for loan applicants to help them effectively plan and manage the funds they receive.

According to observations, inadequate training often results in poor money management and contributes to high loan default rates.

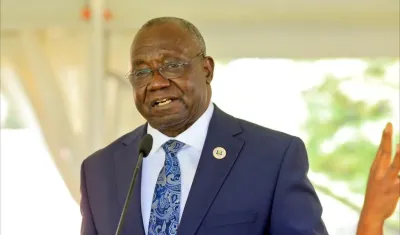

This appeal was made by Chalaire Omagor, the Arua District Education Officer, who expressed concern that many borrowers are currently struggling to repay their loans.

While speaking at the launch of the Unifi Africa microfinance branch in Arua City, Omagor explained that numerous borrowers misuse their loans by spending impulsively and on non-productive items that do not yield returns.

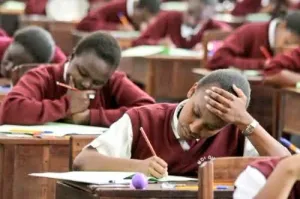

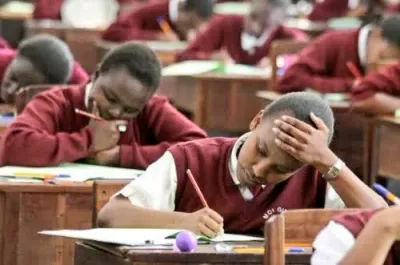

He further noted that in some cases, borrowers take out multiple loans from different institutions, a trend especially common among civil servants such as teachers.

Graham Crawford, the Group CEO of Unifi Africa, recognized the financial management difficulties many people face.

Responding to the call for improved financial literacy, Joyce Amia, the Unifi Africa Arua Branch Manager, stated that providing such training is part of their future plans. She added that it will be implemented under their Corporate Social Responsibility initiatives once the branch is fully established and has completed its local assessments.

Paul Rubongyera

Leave a Comment

Your email address will not be published.