Crime and Security

Sh60 Billion Bank of Uganda Fraud: Investigations Ongoing as Court Hears Progress Update

The Office of the Director of Public Prosecutions (ODPP) has confirmed that investigations into the alleged fraud involving Sh60 billion siphoned from the Bank of Uganda (BoU) are still underway, with key suspects from the Ministry of Finance and BoU already charged but out on bail.

Appearing before the Anti-Corruption Court on Monday, Chief State Attorney Richard Birivumbuka told Chief Magistrate Rachael Nakyazze that police inquiries are ongoing, as authorities work to build a comprehensive case against the nine accused individuals.

The suspects, implicated in what is now considered one of Uganda’s most sophisticated financial frauds in recent memory, are alleged to have manipulated payment systems in a coordinated scheme that caused a loss of $652,588.20 (approx. UGX 2.5 billion). The broader scandal reportedly involved the diversion of nearly UGX 60 billion through forged electronic payment instructions and false procurement claims.

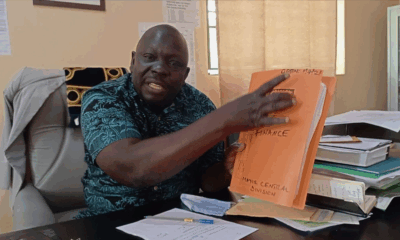

Among the accused are high-ranking officials: Lawrence Ssemakula, Accountant General at the Ministry of FinanceJennifer Muhuruzi, Acting Director of Treasury Services and Asset Management, Paul Nkalubo Lumala, IT Systems Officer, Deborah Dorothy Kusiima, Senior Accountant, Judith Ashaba, Accountant, Bettina Nayebare, Research Assistant, Mark Kasiiku, IT Systems Officer, Tonny Yawe, Senior IT Officer, Pedison Twesigomwe, Assistant Commissioner for Accounts

They face 11 charges, including corruption, causing financial loss, electronic fraud, and money laundering. The prosecution alleges that some suspects failed to implement basic safeguards while others actively altered payment instructions meant for genuine recipients, instead diverting funds to a Polish firm, Road-Way Company Ltd, under the guise of purchasing recycling plant systems and machinery.

Initially suspected to be a cyber heist, investigations later revealed that the fraud was an internal scheme, executed without external hacking. Forensic analysis by the ICT division of the Criminal Investigations Directorate (CID) concluded that payment instruction files originally from the International Development Association (IDA) in Washington were manipulated within the system.

According to the prosecution, Tonny Yawe played a central role in altering files, while Pedison Twesigomwe facilitated the release of funds to fraudulent recipients. The conspiracy allegedly exploited weak oversight protocols and internal collusion within key government departments.

Funds were reported missing from BoU accounts in September 2024. Investigators traced the money to bank accounts in the United Kingdom, Japan, and other Asian countries. At least 21 officials were interrogated by the end of 2024, and electronic gadgets, including mobile phones and laptops, were seized for forensic examination.

Efforts to recover the money have seen mixed success. Sources say more than half of the stolen funds have been recovered through cooperation with UK banks. However, the portion routed to Asia remains unrecovered, with investigators fearing it may have been withdrawn or laundered back into Uganda through cash smuggling or disguised imports.

Following the revelations, President Yoweri Museveni instructed the Defence Intelligence and Security (formerly the Chieftaincy of Military Intelligence) to support the investigation, underscoring the gravity of the case and its national security implications.

Chief Magistrate Nakyazze adjourned the matter to August 20, 2025, pending the conclusion of investigations and possible committal to the High Court for trial.

As the probe continues, the case is seen as a critical test of Uganda’s resolve to fight high-level corruption within its financial institutions, especially at a time when public trust in fiscal governance remains fragile.

Comments