Finance and Banking

Uganda’s Central Bank Keeps Policy Rate at 9.75%, Projects Strong Growth in 2025/26

The Bank of Uganda’s Monetary Policy Committee (MPC) has once again kept the Central Bank Rate (CBR) unchanged at 9.75 percent, maintaining its stance for more than a year.

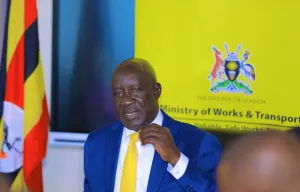

Governor Michael Atingi-Ego said the decision reflects the Bank’s confidence in the improving domestic economy, even as global risks continue to pose uncertainty. The CBR, an indicative rate that influences the cost of borrowing across the banking sector—guides how much commercial banks pay when they borrow from the central bank. A higher rate helps to control the amount of money circulating in the economy, keeping inflation in check.

According to the Uganda Bureau of Statistics, headline inflation for the 12 months ending October 2025 stood at 3.6 percent, remaining well below the central bank’s medium-term target of 5 percent.

“The inflation outlook has been revised slightly downward relative to the August 2025 forecast. Core inflation is now projected to range between 4.0 percent and 4.5 percent, compared to the range of 4.5 to 4.8 percent in the previous forecast for financial 2025/26, which remains below the 5 percent target over the next 12 months,” said the Governor. He added that this revision reflects “a more appreciated exchange rate and a supportive external environment amid easing global inflation.”

Dr Atingi-Ego said the overall outlook remains broadly balanced, shaped by both upward and downward risks. Upside risks include “heightened geopolitical tensions that could disrupt global energy and food supply chains, adverse weather conditions that constrain agricultural output, and exchange rate pressures from weaker capital inflows or delayed oil revenues.”

He further noted that stronger domestic demand, especially from public investment, could raise core inflation pressures. On the other hand, “downside risks… include continued capital inflows related to oil sector developments, favourable weather conditions enhancing food supply, and easing global monetary conditions that could lower imported inflation.”

“Overall, the inflation outlook remains balanced, with core inflation expected to remain close to the medium-term target,” he said.

Official projections show Uganda’s economy expanding 6.4–7.0 percent in the 2025/26 financial year, with medium-term growth expected to average around 8 percent. “This reflects Uganda’s sustained economic resilience, underpinned by a slight improvement in global growth, prudent monetary policy, and targeted fiscal measures that have preserved macroeconomic stability and reinforced investor confidence.”

While domestic conditions continue to strengthen, the MPC said it remains cautious of potential global and local shocks that could alter the near-term outlook. As a result, the Central Bank Rate has been maintained at 9.75 percent.

Sunrise reporter

Leave a Comment

Your email address will not be published.