Letters

URA’s proposed land tax is selective and unfair!

URA Chairman Gerald Sendaula

The principle is definitely laudable especially in view of the explanation URA has always advanced saying that Uganda has the lowest Tax – to GDP ratio of a niggardly 13% in the whole of the East African Community, URA needs to be reminded that land is just one form in which Ugandans choose to keep their wealth just as they can similarly choose to keep it in many other forms including buildings, live stock and bank deposits among others.

Let us consider for a second, the analogy of 3 people keeping their wealth in form of money with 3 different commercial banks A, B and C just as an example.

Natural justice will no doubt judge any tax body of URA’s caliber wrong, for selectively taxing a citizen who freely chooses to keep his wealth(money in this case) with bank A leaving out banks B and C to go scot-free in disregard of the basic taxation principles of fairness and equitability!

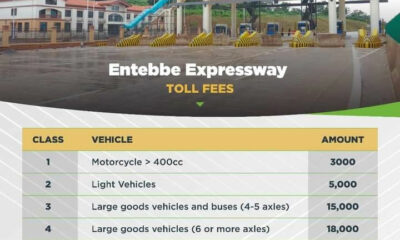

It goes without saying therefore that if URA is considering taxing our wealth, of which land is just one small part, let them not dare do so exclusively. But let us instead open up the list to include all forms of our wealth such as, Vehicles, Television sets, commercial Live stock, residential buildings and loads of idle money lying in Banks etc,

That said and done, URA should also consider plugging the existing lope holes in our tax system in form of, among others, unreasonable tax holidays to investors and exemptions to which Uganda continues to lose billions each passing year.

For God and my country!

By Peter Olupot

Comments